- Founded: 2016

- Headquarters: UAE

- Min deposit: 10 USD

- Max Leverage: 1 : 500

YaMarkets is a well-established broker that has been gaining traction in the MENA region. With a focus on providing a robust trading platform, competitive fees, and excellent customer service, YaMarkets aims to cater to both novice and experienced traders. This review provides a detailed analysis of YaMarkets, covering key aspects such as fees, platform usability, account types, customer support, and regulatory compliance.

Company Overview

YaMarkets offers a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. The broker is known for its user-friendly platform, making it accessible for traders of all skill levels. Additionally, YaMarkets provides educational resources to help traders improve their strategies and market understanding.

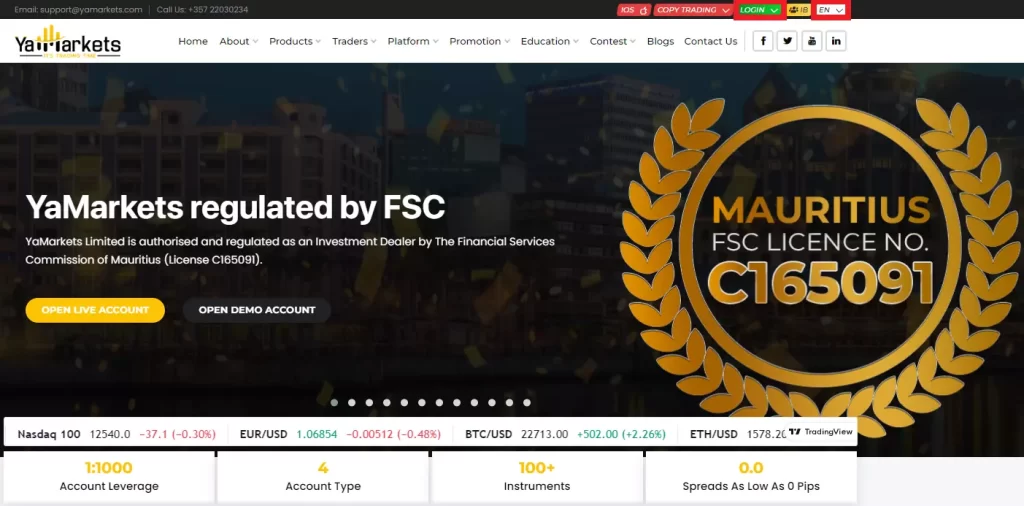

Regulation and Safety

Regulation and safety are paramount when selecting a broker, and YaMarkets takes these aspects seriously. YaMarkets is regulated by the Financial Services Authority (FSA) of Seychelles, ensuring compliance with international standards of financial conduct. The FSA’s oversight provides a level of security and trust, as it requires brokers to adhere to strict guidelines designed to protect investors’ interests.

In addition to regulatory compliance, YaMarkets employs robust safety measures to safeguard client funds and personal information. The broker uses advanced encryption technologies to ensure that all transactions and data transfers are secure. Client funds are kept in segregated accounts, separate from the broker’s operational funds, reducing the risk of misappropriation.

YaMarkets also offers negative balance protection, which prevents clients from losing more than their initial investment. This feature is particularly beneficial in volatile markets, where sudden price movements can lead to significant losses.

Trading Platforms

YaMarkets provides traders with a choice of powerful trading platforms, each designed to cater to different trading styles and preferences. The primary platforms offered are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both renowned for their reliability, user-friendly interface, and advanced trading tools.

MetaTrader 4 (MT4):

MT4 is a favorite among traders for its intuitive interface and comprehensive suite of tools. It offers advanced charting capabilities, a wide range of technical indicators, and automated trading options through Expert Advisors (EAs). The platform supports multiple order types and execution modes, providing flexibility for different trading strategies. MT4 is available on desktop, web, and mobile versions, ensuring that traders can access their accounts and trade from anywhere at any time.

MetaTrader 5 (MT5):

MT5 is the successor to MT4, offering enhanced features and functionality. It includes additional timeframes, more technical indicators, and a built-in economic calendar. MT5 supports both netting and hedging systems, catering to traders who employ different risk management strategies. The platform also offers improved execution speeds and an extended range of pending orders, making it suitable for more advanced trading strategies. Like MT4, MT5 is accessible on desktop, web, and mobile devices.

Both platforms are equipped with one-click trading, allowing traders to execute orders swiftly in fast-moving markets. YaMarkets also provides a demo account for both platforms, enabling traders to practice their strategies and familiarize themselves with the platform’s features without risking real money.

Account Types

YaMarkets offers a variety of account types designed to meet the needs of different traders, from beginners to professionals. Each account type comes with its own set of features and benefits, allowing traders to choose the one that best suits their trading style and financial goals.

Standard Account:

The Standard Account is ideal for beginner traders who are just starting out. It requires a low minimum deposit and offers competitive spreads, making it accessible for those with limited capital. The account provides access to all trading instruments available at YaMarkets, including forex, commodities, indices, and cryptocurrencies. Traders can benefit from a leverage of up to 1:500, allowing them to amplify their trading potential.

Pro Account:

The Pro Account is designed for more experienced traders who require tighter spreads and faster execution speeds. This account type offers lower spreads compared to the Standard Account, and it supports all the advanced features of the MT4 and MT5 platforms. The Pro Account also provides access to exclusive trading tools and analytics, helping traders make more informed decisions.

VIP Account:

The VIP Account is tailored for professional traders and high-net-worth individuals who demand the best trading conditions. It offers the tightest spreads, priority customer support, and personalized trading advice. VIP Account holders also receive access to premium features such as custom trading signals and market insights. This account type requires a higher minimum deposit, reflecting the premium services and benefits it provides.

Islamic Account:

YaMarkets understands the importance of accommodating traders who follow Islamic principles. The Islamic Account, also known as a swap-free account, is designed for Muslim traders who cannot pay or receive interest due to religious reasons. This account type provides the same features and benefits as the Standard Account but without any swap or rollover charges on overnight positions.

Trading Instruments

YaMarkets offers an extensive range of trading instruments, making it a versatile choice for traders interested in diversifying their portfolios. Here’s a breakdown of the primary trading instruments available:

- Forex: As one of the leading brokers in the MENA region, YaMarkets provides access to a wide array of currency pairs, including major, minor, and exotic pairs. This extensive selection allows traders to capitalize on forex market movements globally.

- Commodities: Traders can also engage in commodity trading with YaMarkets, including popular options like gold, silver, crude oil, and natural gas. This diversification helps in hedging against market volatility and inflation.

- Indices: For those interested in the broader market trends, YaMarkets offers trading on major global indices such as the S&P 500, NASDAQ, FTSE 100, and more. This option is excellent for traders looking to speculate on the performance of entire economies rather than individual stocks.

- Stocks: YaMarkets provides access to a wide range of stocks from leading global exchanges. This selection includes shares from prominent companies across various sectors, enabling traders to benefit from stock market trends.

- Cryptocurrencies: With the growing interest in digital currencies, YaMarkets has included cryptocurrencies in its offering. Traders can buy and sell popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, among others.

- ETFs: Exchange-traded funds (ETFs) are also available, offering a diversified and relatively low-risk way to invest in a basket of assets.

The breadth of trading instruments at YaMarkets ensures that traders have ample opportunities to explore and capitalize on various markets, aligning with their risk tolerance and investment strategies.

Fees and Spreads

One of the most crucial aspects of choosing a broker is understanding its fee structure and spreads, as these can significantly impact profitability. YaMarkets aims to offer competitive rates, making it an attractive option for cost-conscious traders.

- Spreads: YaMarkets offers variable spreads that can be as low as 0.1 pips for major forex pairs under optimal market conditions. The spreads for other trading instruments like commodities, indices, and cryptocurrencies are also competitive, ensuring that traders can maximize their profits.

- Commissions: Depending on the type of account, YaMarkets may charge a commission. However, many accounts offer commission-free trading with costs built into the spreads. This transparency helps traders understand their cost structure better.

- Deposit and Withdrawal Fees: YaMarkets provides several options for deposits and withdrawals, including bank transfers, credit/debit cards, and e-wallets. The broker does not charge fees for deposits, and withdrawal fees are relatively low, making it easier for traders to access their funds without incurring significant costs.

- Inactivity Fees: It’s important to note that YaMarkets charges an inactivity fee if an account remains dormant for a specified period. This fee is standard across many brokers and can be avoided by maintaining regular trading activity.

The overall fee structure at YaMarkets is designed to be competitive and transparent, allowing traders to focus on their trading strategies rather than worrying about hidden costs.

Pros and Cons

- Competitive Spreads: YaMarkets offers competitive variable spreads that can be as low as 0.1 pips for major forex pairs, ensuring traders can maximize their potential profits.

- Commission-Free Accounts: Many account types at YaMarkets provide commission-free trading, incorporating costs into the spreads, which simplifies the cost structure for traders.

- Low Deposit and Withdrawal Fees: YaMarkets does not charge fees for deposits and has relatively low withdrawal fees, making it cost-effective for traders to manage their funds.

- Transparent Fee Structure: The broker maintains a clear and transparent fee structure, allowing traders to understand and anticipate their trading costs without hidden charges.

- Inactivity Fees: YaMarkets charges an inactivity fee if an account remains dormant for a specified period, which can be a disadvantage for traders who do not trade frequently.

- Variable Spreads: While variable spreads can be low, they may widen during periods of high market volatility, potentially increasing trading costs unexpectedly.

- Commission on Certain Accounts: Some account types may include a commission per trade, which can add to the overall cost, especially for high-frequency traders.

- Fee Variability: Depending on the payment method used for withdrawals, there might be variations in fees, which could affect the overall cost efficiency for some traders.

Leverage Options

Leverage is a powerful tool that allows traders to control larger positions with a relatively small amount of capital. YaMarkets offers flexible leverage options, catering to both novice and experienced traders.

Forex Leverage: For forex trading, YaMarkets provides leverage up to 1:500, enabling traders to amplify their positions and potential profits. This high leverage is particularly beneficial for traders who have a solid understanding of the forex market and can manage the associated risks.

Commodities and Indices Leverage: The leverage for commodities and indices varies but generally ranges from 1:50 to 1:200, depending on the specific instrument and market conditions. This leverage allows traders to take advantage of price movements in these markets with relatively low capital investment.

Stocks Leverage: When trading stocks, leverage is typically lower compared to forex and commodities, with options up to 1:20. This lower leverage reflects the higher risk associated with stock trading and aims to protect traders from significant losses.

Cryptocurrencies Leverage: Given the volatility of the cryptocurrency market, YaMarkets offers leverage up to 1:10 for digital currencies. This conservative leverage helps mitigate the risks associated with the high price swings in the crypto market.

YaMarkets’ flexible leverage options provide traders with the ability to tailor their trading strategies according to their risk appetite and market experience. However, it is essential to use leverage wisely, as it can magnify both profits and losses.

Customer Support

One of the standout features of YaMarkets is its exceptional customer support. Recognizing the diverse and fast-paced nature of the trading environment, YaMarkets offers multiple channels through which clients can seek assistance. These include live chat, email, and phone support.

Live Chat: The live chat feature on the YaMarkets website is available 24/5, providing real-time assistance to traders. This service is particularly beneficial for those who need immediate help with issues such as platform navigation, account setup, or technical difficulties. The response times are impressive, with representatives typically responding within minutes.

Email Support: For more detailed inquiries or issues that may require escalation, YaMarkets offers a dedicated email support service. Clients can expect a response within 24 hours, with most queries being resolved promptly. The support team is knowledgeable and can assist with a wide range of topics, from account verification to complex trading queries.

Phone Support: YaMarkets also provides phone support for clients who prefer direct communication. The support lines are available during market hours, ensuring that traders can get timely help when needed. The customer service representatives are courteous, professional, and well-versed in various aspects of the trading platform and market conditions.

In addition to these channels, YaMarkets offers an extensive FAQ section on their website. This resource covers a broad spectrum of topics, providing self-help options for common issues. Overall, the customer support at YaMarkets is top-notch, reflecting the broker’s commitment to ensuring a smooth and hassle-free trading experience for its clients.

Payment Methods

When it comes to funding and withdrawing from trading accounts, YaMarkets offers a variety of payment methods to cater to the diverse needs of traders in the MENA region. The broker’s payment system is designed to be both secure and convenient, facilitating smooth transactions for its users.

Bank Transfers: YaMarkets supports traditional bank transfers, allowing clients to deposit and withdraw funds directly from their bank accounts. This method is favored for its reliability and security, although it may take a few business days for transactions to be processed.

Credit and Debit Cards: For faster transactions, traders can use credit or debit cards. YaMarkets accepts major cards such as Visa and MasterCard, enabling instant deposits and quick withdrawals. This method is highly convenient for traders who require immediate access to their funds.

E-Wallets: In response to the growing popularity of digital payment solutions, YaMarkets supports several e-wallets, including Neteller and Skrill. E-wallets offer the advantage of swift processing times and added security, making them a preferred choice for many traders. Transactions via e-wallets are usually completed within 24 hours, providing quick access to funds.

Local Payment Solutions: Understanding the unique needs of traders in the MENA region, YaMarkets also offers local payment solutions. These options cater specifically to the regional market, ensuring that traders can fund their accounts and withdraw their earnings using methods that are familiar and convenient to them.

YaMarkets does not charge any fees for deposits, although some withdrawal methods may incur a nominal fee. It is advisable for traders to check the specific terms and conditions related to their preferred payment method. Overall, the variety and flexibility of payment methods at YaMarkets make it easy for traders to manage their accounts efficiently.

Supported Languages

Given the linguistic diversity of the MENA region, YaMarkets has made significant efforts to ensure that its platform is accessible to a broad audience by supporting multiple languages. This inclusivity enhances the trading experience for clients who may not be fluent in English.

Arabic: As the primary language of many countries in the MENA region, Arabic is fully supported by YaMarkets. The website, trading platform, and customer support services are all available in Arabic, ensuring that traders can navigate the site and communicate with support staff in their native language.

English: English is also widely supported, catering to both local traders who are proficient in the language and expatriates residing in the MENA region. The comprehensive support in English ensures that a broader audience can effectively utilize the platform and its services.

Additional Languages: In addition to Arabic and English, YaMarkets supports several other languages to accommodate the diverse needs of its client base. This multilingual support includes languages commonly spoken in the region and by international traders who might be using the platform.

The ability to access the platform and customer support in multiple languages is a significant advantage for YaMarkets, as it demonstrates the broker’s commitment to inclusivity and user-friendliness. It also ensures that language barriers do not hinder traders from making the most of the trading opportunities available to them.

Conclusion

YaMarkets is a solid choice for traders in the MENA region, offering a combination of competitive fees, a robust trading platform, and excellent customer support. The broker’s focus on education and regulatory compliance further enhances its appeal. While the inactivity fee and withdrawal charges are minor drawbacks, the overall benefits of trading with YaMarkets outweigh these concerns. Whether you are a novice trader looking to get started or an experienced trader seeking a reliable broker, YaMarkets is worth considering for your trading needs.

FAQs

YaMarkets is a leading online brokerage firm catering to traders in the MENA region. The broker offers a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies, through a user-friendly trading platform.

YaMarkets does not charge any fees for deposits. However, some withdrawal methods may incur nominal fees. It is recommended to check the specific terms and conditions for each payment method on the YaMarkets website.

Yes, YaMarkets is a regulated broker. It adheres to strict regulatory standards to ensure the safety and security of its clients’ funds and personal information. For specific regulatory details, you can visit the YaMarkets website or contact their customer support.

YaMarkets offers a robust trading platform that includes both desktop and mobile versions, ensuring traders can access their accounts and execute trades seamlessly from any device. The platform is equipped with advanced charting tools, technical indicators, and various order types to suit different trading strategies.

Yes, YaMarkets provides a range of educational resources to help traders improve their skills and knowledge. These resources include webinars, tutorials, e-books, and market analysis, designed to cater to traders of all experience levels.

YaMarkets offers several types of trading accounts to suit different trader needs, including standard accounts, ECN accounts, and Islamic accounts. Each account type has its own features and benefits, such as different leverage options, spreads, and trading conditions. Details about each account type can be found on the YaMarkets website.

Yes, YaMarkets offers a demo account option for new traders or those who want to test the platform without risking real money. The demo account provides virtual funds and simulates real market conditions, allowing traders to practice and develop their strategies.