- Founded: 2010

- Headquarters: Cyprus

- Min deposit: 5 USD

- Max Leverage: 1 : 888

XM is a globally recognized broker known for its extensive range of trading instruments, user-friendly platforms, and strong regulatory framework. Catering to both beginner and experienced traders, XM has established a significant presence in the MENA region. This review provides a detailed analysis of XM’s offerings, focusing on its key features, trading conditions, and overall performance to help you decide if it’s the right broker for you.

Company Overview

Founded in 2009, XM operates under the trading name of Trading Point Holdings Ltd. The broker is regulated by several top-tier financial authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Conduct Authority (FCA) in the UK. In the MENA region, XM is licensed by the Dubai Financial Services Authority (DFSA), ensuring that it adheres to stringent regulatory standards, providing a secure trading environment for its clients.

Regulation and Safety

When it comes to choosing a broker, regulation and safety are paramount. XM excels in this area, providing a secure trading environment regulated by multiple top-tier financial authorities. XM is licensed by:

- Cyprus Securities and Exchange Commission (CySEC): As a CySEC-regulated broker, XM adheres to stringent regulatory standards, ensuring a high level of client protection.

- Australian Securities and Investments Commission (ASIC): ASIC regulation means that XM operates under a strict regulatory framework, offering further assurance of its reliability.

- Financial Conduct Authority (FCA): XM’s FCA regulation underscores its commitment to maintaining high standards of transparency and fairness in its trading practices.

In addition to these regulatory bodies, XM is also registered with several other financial authorities, enhancing its credibility and global reach. These regulations ensure that client funds are kept in segregated accounts, separate from the company’s operating funds. This segregation provides an additional layer of security, ensuring that client funds are protected even if the company faces financial difficulties.

Moreover, XM is a member of the Investor Compensation Fund (ICF) for clients of Cypriot Investment Firms (CIFs). This membership offers compensation to eligible clients in the unlikely event of the broker’s insolvency, providing added peace of mind.

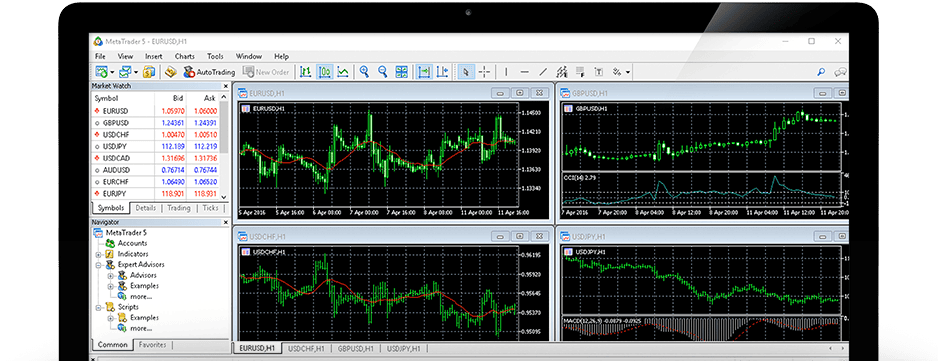

Trading Platforms

XM offers a variety of trading platforms designed to cater to the needs of both novice and experienced traders. The platforms are renowned for their user-friendly interfaces, advanced charting tools, and comprehensive market analysis features.

MetaTrader 4 (MT4): MT4 is one of the most popular trading platforms globally, known for its robust performance and extensive range of trading tools. XM’s MT4 platform supports a wide range of trading instruments, including forex, commodities, indices, and more. Key features of MT4 include advanced charting capabilities, numerous technical indicators, and automated trading through Expert Advisors (EAs).

MetaTrader 5 (MT5): Building on the success of MT4, MT5 offers additional features and enhanced functionality. It supports more order types, improved charting tools, and a larger number of technical indicators. MT5 also includes an integrated economic calendar and more sophisticated analytical tools, making it suitable for traders who require advanced market analysis.

XM WebTrader: For traders who prefer not to download software, XM WebTrader offers the flexibility of trading directly from a web browser. This platform provides the same functionalities as the desktop versions, including real-time quotes, full trading history, and advanced charting tools. It is compatible with both MT4 and MT5 accounts, ensuring a seamless trading experience.

Mobile Trading: XM’s mobile trading platforms for MT4 and MT5 are available on both iOS and Android devices. These mobile apps provide full access to account functionalities, real-time market data, and a wide range of trading tools, allowing traders to manage their accounts and execute trades on the go.

Account Types

XM offers several account types to cater to different trading needs and experience levels. Each account type is designed to provide specific benefits and features, ensuring that traders can find an option that best suits their requirements.

Micro Account: The Micro Account is ideal for beginners or those who prefer to trade smaller volumes. It allows trading in micro lots (1 micro lot = 1,000 units of the base currency) and has a minimum deposit requirement of just $5. This account type offers a high level of flexibility and is an excellent starting point for new traders.

Standard Account: The Standard Account is suitable for more experienced traders who prefer larger trading volumes. It allows trading in standard lots (1 standard lot = 100,000 units of the base currency) and also has a minimum deposit requirement of $5. This account type provides access to all trading instruments and features, including the full range of MT4 and MT5 functionalities.

XM Zero Account: The XM Zero Account is designed for traders who prioritize low trading costs. It offers spreads as low as 0 pips, with a commission charged per trade. The minimum deposit requirement for this account is $100. This account type is ideal for traders who use high-frequency or scalping strategies, as it minimizes trading costs while providing access to the full range of trading instruments.

Islamic Account: XM also offers Islamic accounts that comply with Sharia law, ensuring that Muslim traders can engage in trading without violating their religious principles. These accounts do not incur swap or rollover charges on overnight positions, making them suitable for traders who follow Islamic finance principles.

Shares Account: The Shares Account is tailored for traders who wish to trade shares exclusively. It requires a minimum deposit of $10,000 and offers access to over 100 shares from major global markets. This account type is ideal for traders focused on equity investments and looking to diversify their portfolios.

Trading Instruments

One of XM’s standout features is its extensive selection of trading instruments. Clients have access to over 1,000 instruments across various asset classes, including:

Forex: XM offers 55+ currency pairs, covering major, minor, and exotic pairs. This makes it a versatile choice for forex traders seeking diverse trading opportunities.

Commodities: Trade on a range of commodities such as gold, silver, oil, and agricultural products. XM’s commodity offerings provide an excellent way to diversify your portfolio.

Indices: With 30+ stock indices from major global markets, XM allows traders to speculate on the performance of various economies without the need to buy individual stocks.

Stocks: XM provides access to over 600 stocks from leading global companies. This wide selection enables traders to invest in individual equities and benefit from stock market movements.

Cryptocurrencies: Although not as extensive as some brokers, XM offers a selection of popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple.

Metals and Energies: Apart from traditional commodities, XM also offers trading on metals like palladium and platinum, as well as energy products like natural gas.

This broad range of instruments ensures that XM caters to traders with diverse interests and strategies, whether they prefer forex trading, stock market investments, or commodity speculation.

Fees and Spreads

XM is renowned for its transparent and competitive fee structure. Here’s a detailed look at what you can expect:

Spreads: XM offers variable spreads, with the spreads on major currency pairs like EUR/USD starting from as low as 0.6 pips. The average spread is around 1.7 pips, which is competitive within the industry.

Commission: XM primarily operates on a spread-only model, meaning there are no commissions on forex trading and most other instruments. This is advantageous for traders looking to minimize transaction costs.

Deposit and Withdrawal Fees: XM stands out by offering free deposits and withdrawals across all account types. This includes bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. The absence of deposit and withdrawal fees is a significant benefit for traders who frequently move funds.

Inactivity Fee: XM charges an inactivity fee of $5 per month after 90 days of no trading activity. While this is relatively standard in the industry, active traders will likely never encounter this fee.

In terms of fees and spreads, XM provides a cost-effective trading environment, particularly appealing to traders who execute a high volume of trades or prefer to keep their trading costs predictable.

Pros and Cons

Competitive Spreads: XM offers variable spreads starting from as low as 0.6 pips on major currency pairs like EUR/USD. This is competitive and beneficial for traders looking to minimize their trading costs.

Commission-Free Trading: For most instruments, XM operates on a spread-only model, meaning traders do not have to pay additional commissions on their trades. This can significantly reduce the overall cost of trading.

No Deposit and Withdrawal Fees: XM does not charge fees for deposits and withdrawals, which is a significant advantage for traders who frequently move funds in and out of their accounts. This applies to various payment methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller.

Transparent Fee Structure: XM maintains a transparent fee structure, ensuring that traders are fully aware of any potential costs. This transparency helps traders manage their budgets more effectively and avoid unexpected charges.

Variable Spreads: While variable spreads can be low, they can also widen significantly during periods of high market volatility. This can increase trading costs unpredictably, which might be a concern for some traders.

Inactivity Fee: XM charges an inactivity fee of $5 per month after 90 days of no trading activity. Although this is standard in the industry, it can be a disadvantage for traders who do not trade frequently.

Higher Spreads on Some Instruments: Although spreads on major currency pairs are competitive, the spreads on some other instruments, such as minor or exotic currency pairs, can be higher. Traders dealing with these instruments might find the costs less favorable.

Spread-Only Model Limitations: While the spread-only model is advantageous for most traders, those who prefer a commission-based structure for greater predictability in costs might find XM’s model limiting.

Leverage Options

Leverage is a critical component of trading, allowing traders to control larger positions with a smaller amount of capital. XM offers flexible leverage options, catering to both conservative and aggressive traders.

Leverage Ranges: Depending on the instrument and account type, XM offers leverage ranging from 1:1 to 888:1. This high leverage is available for forex trading, providing significant potential for amplifying profits, though it also increases the risk of losses.

Risk Management: To mitigate the risks associated with high leverage, XM provides several risk management tools, including negative balance protection and margin call alerts. These tools help ensure that traders do not lose more than their initial investment, promoting responsible trading practices.

Professional Traders: For professional clients, XM offers tailored leverage options that can exceed the standard limits, depending on the trader’s experience and trading strategy.

XM’s leverage offerings are versatile and designed to accommodate different trading styles and risk appetites. However, it’s crucial for traders to understand the risks involved and use leverage judiciously.

Customer Support

One of XM’s standout features is its exceptional customer support. Understanding the diverse needs of traders in the MENA region, XM offers support that is both comprehensive and accessible.

Availability and Accessibility

XM’s customer support is available 24/5, ensuring that traders can get assistance during the critical hours when markets are open. The support team is reachable via multiple channels, including live chat, email, and telephone. This multi-channel approach ensures that traders can choose the most convenient method to resolve their issues swiftly.

Responsiveness and Efficiency

The response times at XM are impressively quick. During our review, live chat queries were addressed within minutes, and email responses were typically received within a few hours. The support staff is not only prompt but also highly knowledgeable, capable of resolving technical issues, providing trading advice, and answering account-related queries efficiently.

Payment Methods

A crucial aspect of any trading platform is the availability and flexibility of payment methods. XM excels in this area by offering a wide range of deposit and withdrawal options tailored to the needs of traders in the MENA region.

Deposits

XM provides numerous deposit methods, including bank transfers, credit/debit cards, and various e-wallets. Popular options such as Skrill, Neteller, and PayPal are available, catering to traders who prefer digital payment solutions. Additionally, XM does not charge any fees for deposits, which is a significant advantage for traders looking to maximize their trading capital.

Withdrawals

The withdrawal process at XM is straightforward and efficient. Traders can use the same methods for withdrawals as they do for deposits, ensuring consistency and convenience. Withdrawal requests are typically processed within 24 hours, which is relatively fast compared to industry standards. Furthermore, XM covers all transfer fees, ensuring that traders receive their funds without any deductions.

Local Payment Options

To cater specifically to clients in the MENA region, XM supports local payment methods, including local bank transfers. This feature allows traders to deposit and withdraw funds in their local currency, avoiding the hassle and costs associated with currency conversion.

Supported Languages

XM demonstrates a strong commitment to accommodating traders from diverse linguistic backgrounds. This is particularly important in the MENA region, where multiple languages are spoken.

Multilingual Platform

The XM platform supports over 25 languages, including English and Arabic, the primary languages in the MENA region. This multilingual support extends to both the trading platform and the official website, ensuring that traders can navigate the site, access educational resources, and trade with ease in their preferred language.

Customer Support Languages

In addition to the platform itself, XM’s customer support services are available in multiple languages. The availability of Arabic-speaking support agents is a significant advantage for clients in the MENA region, ensuring that they can receive assistance in their native language.

Educational Resources

XM provides a wealth of educational materials in multiple languages. These include webinars, video tutorials, articles, and e-books designed to help traders enhance their skills and knowledge. The availability of these resources in both English and Arabic makes them accessible to a broader audience in the MENA region, supporting traders of all experience levels.

Conclusion

XM stands out as a reputable and reliable broker in the MENA region, offering a comprehensive suite of trading instruments, robust platforms, and strong regulatory oversight. Its commitment to education, competitive fee structure, and excellent customer support make it an attractive choice for both novice and experienced traders. While there are minor drawbacks, such as limited cryptocurrency offerings and inactivity fees, the overall benefits far outweigh these concerns.

For traders in the MENA region looking for a secure, well-regulated, and versatile broker, XM is a solid choice. With its extensive range of services and commitment to client satisfaction, XM continues to be a preferred broker for many in the financial trading community.

FAQs

XM is a globally recognized online broker that offers a wide range of financial instruments for trading, including forex, commodities, indices, and cryptocurrencies. Established in 2009, XM has built a reputation for providing reliable and user-friendly trading services, with a strong focus on customer satisfaction.

Yes, XM is regulated by several leading financial authorities, ensuring that it operates under strict standards. These regulatory bodies include the International Financial Services Commission (IFSC), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). This multi-regulatory framework provides traders with a secure trading environment.

XM offers various account types to suit different trading needs and experience levels. These include the Micro Account, Standard Account, XM Ultra Low Account, and Shares Account. Each account type has its own features and benefits, such as different minimum deposit requirements, leverage options, and trading conditions.

XM supports a wide range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and popular e-wallets like Skrill, Neteller, and PayPal. Additionally, XM offers local payment options for traders in the MENA region, such as local bank transfers. XM does not charge fees for deposits or withdrawals, and most transactions are processed quickly.

XM provides exceptional customer support available 24/5 via live chat, email, and telephone. The support team is responsive, knowledgeable, and capable of addressing various issues, from technical problems to account inquiries. XM also offers localized support in multiple languages, including Arabic, ensuring that traders in the MENA region receive assistance in their preferred language.

XM offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are available on multiple devices, including desktop, web, and mobile, providing traders with flexibility and convenience. Both platforms come with advanced charting tools, technical analysis capabilities, and automated trading options.

XM offers competitive trading fees and low spreads across its various account types. For most accounts, XM does not charge commissions, with costs being included in the spreads. However, the XM Ultra Low Account offers even tighter spreads with a small commission fee. Detailed information about fees and spreads can be found on the XM website.