- Founded: 2000

- Headquarters: Switzerland

- Min deposit: 1000 USD

- Max Leverage: 1 : 100

Swissquote is a well-established online broker that has garnered a solid reputation over the years. Based in Switzerland, Swissquote offers a diverse range of financial services, including online banking and investment solutions. With its commitment to transparency, security, and innovative technology, Swissquote has become a go-to platform for both retail and institutional traders worldwide. In this review, we will explore the various aspects of Swissquote, including its trading platforms, range of tradable assets, and the different account types available.

Company overview

Swissquote was founded in 1996 and is headquartered in Gland, Switzerland. Over the years, it has expanded its services and is now publicly listed on the SIX Swiss Exchange. The company is regulated by the Swiss Financial Market Supervisory Authority (FINMA), which guarantees that Swissquote operates under stringent guidelines to ensure client funds’ security and operational transparency. In addition to its primary operations in Switzerland, Swissquote has offices in several financial hubs, including London, Dubai, Hong Kong, and Singapore, further extending its global reach.

Swissquote is known for providing a wide range of financial products and services, catering to investors of all experience levels. It offers access to more than 3 million financial products across different asset classes, making it a comprehensive platform for traders. Swissquote’s reputation for reliability, customer service, and its commitment to innovation make it a standout in the competitive world of online brokers.

Regulation and Safety

Swissquote’s reputation for safety and security is rooted in its strict adherence to regulatory standards. The broker is regulated by some of the most reputable financial authorities in the world. These include:

Swiss Financial Market Supervisory Authority (FINMA): As a Swiss financial institution, Swissquote operates under the supervision of FINMA, ensuring that it follows strict Swiss banking laws and maintains high standards for transparency, security, and customer protection.

FCA (Financial Conduct Authority): Swissquote’s UK subsidiary is regulated by the FCA, which means it meets the high regulatory standards of the United Kingdom. The FCA is known for its stringent rules, particularly regarding client fund protection and transparency.

CSSF (Commission de Surveillance du Secteur Financier): Swissquote Bank Europe is regulated by CSSF in Luxembourg, adding another layer of European regulatory oversight.

Being under the watchful eyes of multiple regulatory bodies, Swissquote ensures the highest levels of safety for its clients. It provides segregated accounts for clients’ funds, ensuring that their money is not mixed with the broker’s operational funds. Moreover, Swissquote participates in compensation schemes such as the UK’s Financial Services Compensation Scheme (FSCS), which guarantees protection for client deposits up to a certain limit in case of broker insolvency.

Furthermore, Swissquote is renowned for its robust cybersecurity measures. It employs industry-standard encryption protocols, two-factor authentication (2FA), and frequent system updates to keep client accounts and personal information secure.

Trading Platforms

Swissquote offers multiple trading platforms to cater to different types of traders, ranging from beginners to professionals. Here’s a look at some of its most popular platforms:

Advanced Trader: This is Swissquote’s proprietary platform designed to provide a sleek and powerful trading experience. The platform features advanced charting tools, customizable layouts, and a wide array of technical indicators. It’s designed for both experienced and intermediate traders who seek precision and fast execution.

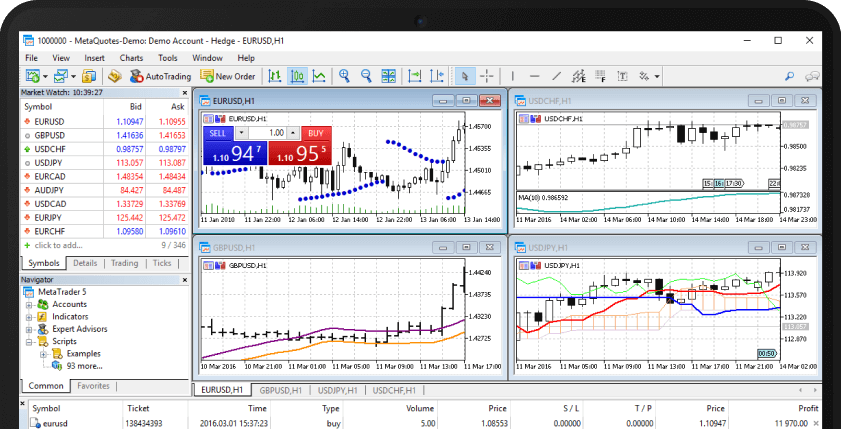

MetaTrader 4 (MT4): One of the most widely-used platforms in the world, MT4 is a favorite among forex and CFD traders. Swissquote offers MT4 with full support for Expert Advisors (EAs), advanced charting, automated trading, and back-testing capabilities.

MetaTrader 5 (MT5): The successor to MT4, MT5 offers enhanced features such as a more extensive range of timeframes, more order types, and better performance. It’s ideal for traders looking for more sophisticated trading capabilities, including access to additional markets like stocks and futures.

Swissquote Mobile App: Swissquote’s mobile trading app ensures that traders can access the markets from anywhere. The app is available for both iOS and Android and offers a user-friendly interface, real-time market data, news, and all essential trading features. It’s perfect for those who want to manage their portfolio on the go.

WebTrader: For traders who prefer not to download software, Swissquote’s WebTrader platform provides a browser-based solution with similar functionality to the desktop platforms. It’s accessible from any device with an internet connection, making it a versatile choice for traders who value flexibility.

Swissquote’s platforms are known for their stability and advanced technology, allowing traders to execute trades quickly and efficiently. The availability of multiple platforms ensures that traders of all levels can find a suitable option for their needs.

Account Types

Swissquote offers a range of account types to meet the diverse needs of its clients, including retail traders, professionals, and institutional investors. Here’s a breakdown of the account types available:

Standard Account: This account type is designed for beginner and intermediate traders. It offers access to all major asset classes, including forex, CFDs, stocks, ETFs, and cryptocurrencies. The minimum deposit requirement is reasonable, making it accessible for most retail traders. Leverage options are available depending on the asset class and the trader’s regulatory jurisdiction.

Premium Account: Targeting more experienced traders, the Premium account provides tighter spreads, faster execution speeds, and more advanced trading tools. The minimum deposit is higher than the Standard account, but it offers more favorable conditions for those who trade in larger volumes.

Professional Account: This account is designed for professional traders who meet certain criteria, such as having significant trading experience or managing a large portfolio. It offers even lower spreads, higher leverage (up to 1:200 in some cases), and priority customer support. Professional accounts are subject to eligibility requirements, including a higher level of regulatory protection due to the trader’s presumed expertise.

Corporate Account: Swissquote also caters to businesses and institutions that wish to access global financial markets. Corporate accounts offer tailored solutions, including bespoke trading conditions, dedicated account managers, and access to more sophisticated financial instruments.

Crypto Trading Account: With the rising popularity of cryptocurrencies, Swissquote has introduced a dedicated crypto trading account that allows clients to trade a wide variety of digital currencies, including Bitcoin, Ethereum, Litecoin, and more. This account offers competitive fees, secure storage solutions, and direct access to major cryptocurrency markets.

Each account type comes with its own set of features, including access to educational resources, customer support, and trading tools. The variety of accounts ensures that Swissquote can cater to a broad spectrum of clients, from novice traders to high-net-worth individuals.

Trading Instruments

Swissquote offers a wide variety of trading instruments, providing clients with extensive access to global financial markets. Whether you are interested in trading traditional assets or exploring newer markets like cryptocurrencies, Swissquote ensures that traders have multiple options to diversify their portfolios. The available trading instruments include:

Forex: Swissquote provides access to over 70 currency pairs, including major, minor, and exotic pairs. The platform caters to both beginner and experienced forex traders with competitive spreads and deep liquidity. The forex market is accessible 24/5, making it ideal for traders who want round-the-clock opportunities.

CFDs (Contracts for Difference): Swissquote offers CFDs on a broad range of underlying assets, including commodities, indices, and stocks. Traders can speculate on the price movement of assets without actually owning them, allowing for potentially higher returns through leverage. Swissquote supports CFD trading on commodities like oil, gold, silver, and agricultural products, as well as stock indices such as the S&P 500 and the DAX.

Stocks and ETFs: With access to over 60 stock exchanges worldwide, Swissquote allows traders to invest directly in individual stocks and ETFs (Exchange-Traded Funds). Whether you’re interested in blue-chip companies, small-cap stocks, or sector-specific ETFs, Swissquote offers a broad selection of assets to suit different investment strategies.

Cryptocurrencies: Swissquote has embraced the growing demand for digital assets and offers trading in a wide variety of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and more. Their cryptocurrency trading platform ensures that traders can buy, sell, and hold digital assets in a secure environment.

Bonds: Traders can also invest in government and corporate bonds through Swissquote. Bonds are a popular choice for investors looking for a more conservative approach to portfolio diversification and income generation.

Futures and Options: For more advanced traders, Swissquote provides access to futures and options trading. This allows traders to hedge against risk, speculate on price movements, or take advantage of market volatility in a more strategic manner.

Mutual Funds: Swissquote clients also have access to a selection of mutual funds, which can be an attractive option for long-term investors looking for professionally managed portfolios that focus on specific sectors or regions.

By offering such a diverse range of instruments, Swissquote allows traders to construct well-balanced portfolios that can capture opportunities across different markets and asset classes.

Fees and Spreads

Swissquote’s fee structure is transparent but varies depending on the account type, asset class, and trading volume. Overall, the broker offers competitive fees, though they may not be the lowest in the industry, especially for retail traders. Here’s an overview of the fees and spreads:

Forex Spreads: Swissquote provides competitive forex spreads that start from as low as 0.6 pips on major currency pairs such as EUR/USD. However, the spreads can vary depending on the account type (Standard, Premium, or Professional) and the market conditions. The Professional account typically enjoys tighter spreads due to higher trading volumes, while the Standard account may see slightly wider spreads.

Commissions: Swissquote follows a commission-free model for forex and CFD trading, which means traders are charged only through the spread. However, when trading stocks, ETFs, or other securities, commissions apply. For example, stock trading fees on major exchanges like the NYSE or LSE can range from 0.15% to 0.50% per trade, depending on the asset and exchange.

CFD Fees: Swissquote charges no direct commission on CFD trades, as the broker makes money through the bid-ask spread. The spreads on CFDs vary depending on the asset class, with indices typically offering lower spreads compared to commodities and individual stocks.

Cryptocurrency Fees: Swissquote’s crypto trading fees are relatively competitive for a regulated broker. The spreads for cryptocurrency trades start from 1%, though this can fluctuate based on market conditions and the cryptocurrency being traded.

Stock and ETF Fees: Swissquote charges commissions for trading stocks and ETFs. The fees typically depend on the trading volume and the market where the trade is executed. For European stocks, the commissions can range from 0.10% to 0.15% per trade, with minimum fees applying depending on the exchange.

Account and Inactivity Fees: Swissquote charges a small inactivity fee if an account remains dormant for more than six months. However, there are no deposit fees for transferring money into your Swissquote account, and withdrawal fees are generally minimal.

Overnight Financing (Swap Fees): Like most brokers, Swissquote charges swap fees for holding leveraged positions overnight. These fees vary depending on the instrument and the position (long or short). Swap rates are particularly important for forex and CFD traders using leverage, and they can either result in a cost or a credit to the trader’s account, depending on the direction of the trade and the underlying interest rates.

Swissquote’s fee structure is generally competitive, though some traders may find lower spreads or commissions with discount brokers. However, the value provided in terms of security, platform stability, and customer support can justify the slightly higher fees for many traders.

Pros and Con

Transparent Fee Structure: Swissquote provides clear and detailed information about its fees, ensuring traders understand the cost of each trade without hidden charges.

Commission-Free Forex and CFD Trading: Traders are charged through the spread rather than paying commissions on forex and CFD trades, which can simplify cost management.

Competitive Forex Spreads: Swissquote offers competitive spreads starting from 0.6 pips on major forex pairs, which is favorable for retail traders, especially in the Premium and Professional accounts.

Diverse Instruments with Various Pricing Models: Traders can access a wide range of assets such as stocks, ETFs, cryptocurrencies, and more, each with a tailored fee structure.

No Deposit Fees: There are no charges for depositing funds into a Swissquote account, making it easier and more cost-effective to start trading.

Higher Commissions for Stocks and ETFs: While forex and CFD trading are commission-free, stock and ETF trades come with commission fees that might be higher compared to discount brokers.

Inactivity Fees: Swissquote charges an inactivity fee if the account remains dormant for more than six months, which may deter occasional traders.

Wider Spreads for Standard Accounts: Traders on the Standard account may experience slightly wider spreads compared to Premium or Professional account holders, which could affect profitability for those trading smaller volumes.

Overnight Swap Fees: Swissquote applies swap fees for holding positions overnight, which can add up over time, particularly for traders using high leverage.

Cryptocurrency Trading Fees: While competitive for a regulated broker, the 1% spreads on cryptocurrency trades might still be higher than those offered by dedicated crypto exchanges.

Leverage Options

Leverage allows traders to control larger positions with a relatively small amount of capital, amplifying both potential profits and losses. Swissquote offers flexible leverage ratios that depend on the asset class, account type, and the trader’s regulatory jurisdiction.

Forex Leverage: Swissquote offers leverage on forex trades of up to 1:100 for retail traders and up to 1:200 for professional traders. The exact leverage available will depend on the account type and the trader’s classification (retail or professional). Retail traders under the EU jurisdiction, for example, may be limited to 1:30 leverage due to regulatory restrictions imposed by the European Securities and Markets Authority (ESMA).

CFD Leverage: Leverage for CFD trading also varies depending on the asset class. For example, leverage on indices like the S&P 500 or DAX can go up to 1:100, while commodity CFDs such as gold and oil may have slightly lower leverage limits (up to 1:50).

Cryptocurrency Leverage: Given the volatile nature of cryptocurrencies, Swissquote offers more conservative leverage ratios for digital assets. Leverage typically ranges from 1:2 to 1:5, depending on the cryptocurrency being traded and market conditions.

Stock and ETF Leverage: Swissquote provides leverage of up to 1:5 on stock and ETF trading. This is lower compared to forex and CFDs due to the generally lower volatility in the stock market, though it still allows traders to take on larger positions with a smaller capital outlay.

Professional Account Leverage: Traders who qualify as professional clients have access to higher leverage limits across all asset classes. For example, professional forex traders can access leverage up to 1:200, while professional CFD traders may enjoy leverage of up to 1:100 on major indices and commodities.

It’s important for traders to understand the risks associated with high leverage. While leverage can amplify potential gains, it can also lead to significant losses if the market moves against a trader’s position. Swissquote provides robust risk management tools, such as stop-loss orders and margin calls, to help traders manage their exposure to leveraged positions.

Customer Support

Swissquote places a strong emphasis on providing high-quality customer support to ensure that clients can resolve their queries quickly and efficiently. The broker offers multiple channels for customer assistance, catering to a global audience. Key aspects of Swissquote’s customer support include:

Multichannel Support: Swissquote provides customer support through various channels, including phone, email, and live chat. The live chat feature is particularly helpful for traders looking for immediate assistance without the need for long wait times.

Phone Support: Swissquote offers dedicated phone support in various regions, ensuring that traders can speak directly with a customer service representative. The availability of regional phone numbers is convenient for clients located across Europe and other regions, reducing international calling costs.

Email Support: For non-urgent queries or more complex issues, traders can reach out via email. Swissquote’s email support is generally responsive, with turnaround times usually within 24 hours, depending on the nature of the query.

Comprehensive FAQs and Help Center: Swissquote maintains an extensive FAQ section on its website, covering a wide range of topics related to trading, account management, fees, and platform usage. This self-help section is well-organized and serves as a useful resource for traders who prefer to find answers on their own.

Dedicated Account Managers: Professional and high-volume traders may benefit from Swissquote’s dedicated account managers. These personalized services ensure that traders receive priority support and customized solutions based on their specific trading needs.

Despite its overall strong support system, Swissquote’s customer service could improve in terms of 24/7 availability. As of now, support is generally available during market hours, meaning traders in certain time zones may not have access to instant help during off-hours.

Payment Methods

Swissquote offers a variety of payment methods to cater to its global client base, ensuring ease of deposit and withdrawal. The supported payment methods include:

Bank Wire Transfer: Bank transfers are the most commonly used payment method for deposits and withdrawals. Swissquote supports transfers from both local and international banks, and the process is straightforward. However, wire transfers can take 1-3 business days to process, depending on the bank and location.

Credit/Debit Cards: Swissquote accepts major credit and debit cards, including Visa and MasterCard, for both deposits and withdrawals. This option is faster than a bank transfer, with funds typically available instantly or within a few hours. It’s a convenient choice for traders who want to fund their accounts quickly and begin trading without delay.

eWallets: While Swissquote does not currently support eWallet options like PayPal or Skrill, which are popular among many traders for their convenience and speed, it primarily focuses on traditional methods such as bank transfers and cards.

Cryptocurrency Deposits: Swissquote also supports cryptocurrency deposits for its crypto trading accounts. This method allows traders to transfer digital assets like Bitcoin and Ethereum directly into their Swissquote accounts for trading.

While the variety of payment methods is satisfactory for most clients, the lack of eWallet support may be seen as a downside for those who prefer faster, more flexible options for fund transfers. The withdrawal process is generally smooth, though bank withdrawals may take longer than other methods.

Supported Languages

Swissquote caters to a diverse international client base and offers support in multiple languages. This makes it easier for traders from various regions to communicate and interact with the platform in their preferred language. Supported languages include:

- English

- French

- German

- Italian

- Spanish

- Chinese

- Arabic

The availability of these languages covers many of the major markets where Swissquote operates. For traders who prefer interacting in their native language, the platform’s multilingual support enhances the user experience. Additionally, the website, customer service, and trading platforms are available in these languages, making the broker accessible to a wide range of clients.

Conclusion

Swissquote is a well-established, highly regulated broker that provides a robust and secure environment for traders of all levels. With a wide range of trading instruments, including forex, CFDs, stocks, ETFs, and cryptocurrencies, Swissquote offers diverse opportunities for portfolio diversification. The broker is known for its advanced trading platforms, including its proprietary Advanced Trader platform and the popular MetaTrader 4 and MetaTrader 5.

Swissquote stands out for its strong regulatory framework, being overseen by several top-tier authorities, which ensures a high level of trust and security for traders. While its fees and spreads are competitive, particularly for premium and professional clients, they may not always be the lowest for retail traders compared to other discount brokers.

The customer support is generally efficient, though its availability could be expanded to 24/7 to cater to traders in different time zones. The supported payment methods cover bank transfers, cards, and cryptocurrencies, although the lack of eWallet options might be a drawback for some users.

Overall, Swissquote is a solid choice for traders who prioritize security, advanced technology, and a broad range of trading instruments. Its well-rounded offering makes it suitable for both novice and experienced traders, particularly those looking for a regulated and reliable broker with a global reach.

FAQs

Swissquote is a Swiss-based online broker offering a wide range of financial services and trading instruments. It provides access to forex, CFDs, stocks, ETFs, bonds, options, futures, and cryptocurrencies. Swissquote is known for its advanced trading platforms, strict regulatory compliance, and transparent fee structure.

Yes, Swissquote is regulated by several top-tier financial authorities, including the Swiss Financial Market Supervisory Authority (FINMA), the UK Financial Conduct Authority (FCA), and the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg. This ensures a high level of security, transparency, and compliance with international financial standards.

Swissquote offers several trading platforms to cater to different trader needs:

- Advanced Trader: Swissquote’s proprietary platform with advanced charting tools and fast execution.

- MetaTrader 4 (MT4): A popular platform for forex and CFD traders, known for its automated trading and Expert Advisors (EAs).

- MetaTrader 5 (MT5): The successor to MT4, offering more advanced features and a wider range of trading assets.

- Swissquote Mobile App: A user-friendly app available for iOS and Android, allowing traders to access markets on the go.

- WebTrader: A browser-based platform for those who prefer trading without installing software.

Swissquote has a transparent fee structure, though it varies by account type and asset class. Key points include:

- Forex spreads start as low as 0.6 pips for major pairs.

- No commissions on forex and CFD trades, as costs are built into the spreads.

- Commissions apply for stock and ETF trades, ranging from 0.10% to 0.50% depending on the exchange and trading volume.

- Cryptocurrency spreads start from 1%.

- Swap fees for holding positions overnight.

- Inactivity fees apply after six months of dormancy.

Swissquote supports several payment methods for deposits and withdrawals:

- Bank Wire Transfers: Available for both local and international transactions.

- Credit/Debit Cards: Visa and MasterCard are accepted for faster transactions.

- Cryptocurrency Deposits: Supported for cryptocurrency trading accounts.

However, Swissquote does not currently support eWallets like PayPal or Skrill.

Swissquote’s platform and customer support are available in several languages to cater to its global client base. Supported languages include:

- English

- French

- German

- Italian

- Spanish

- Chinese

- Arabic

Yes, Swissquote is beginner-friendly, with comprehensive educational resources, market analysis tools, and a user-friendly platform. The Standard account, in particular, is designed for novice traders, with a reasonable minimum deposit and access to various asset classes.