- Founded: 2007

- Headquarters: Cyprus

- Min deposit: 200 USD

- Max Leverage: 1 : 400

In the rapidly evolving world of online trading, choosing the right broker is crucial for both novice and experienced traders. eToro, a well-established broker known for its innovative social trading platform, has made a significant impact in the MENA region. This review provides an in-depth analysis of eToro, covering its company overview, regulation and safety, trading platforms, and account types, helping investors make an informed decision.

Company Overview

Founded in 2007, eToro has grown to become a global leader in the online trading industry. Headquartered in Tel Aviv, Israel, eToro operates in over 140 countries and serves millions of users worldwide. The platform is renowned for pioneering social trading, allowing users to replicate the trades of successful investors. This feature has democratized trading, making it accessible to a broader audience.

eToro offers a wide range of assets for trading, including stocks, commodities, cryptocurrencies, forex, and ETFs. The platform’s user-friendly interface and innovative tools cater to traders of all levels, from beginners to seasoned professionals. With a strong emphasis on community engagement, eToro provides a unique trading experience that combines social interaction with financial investing.

Regulation and Safety

Regulation is a critical aspect of any broker, and eToro excels in this regard. The company is regulated by multiple financial authorities, ensuring a high level of security and compliance. Some of the key regulatory bodies overseeing eToro include:

- Cyprus Securities and Exchange Commission (CySEC): eToro Europe is regulated by CySEC, ensuring compliance with EU financial regulations.

- Financial Conduct Authority (FCA): eToro UK is regulated by the FCA, one of the most respected financial regulatory bodies in the world.

- Australian Securities and Investments Commission (ASIC): eToro AUS Capital Pty Ltd is regulated by ASIC, providing additional oversight and security for Australian clients.

These regulatory approvals demonstrate eToro’s commitment to maintaining a secure and transparent trading environment. In addition to regulatory compliance, eToro implements advanced security measures, such as SSL encryption and two-factor authentication, to protect users’ data and funds.

Trading Platforms

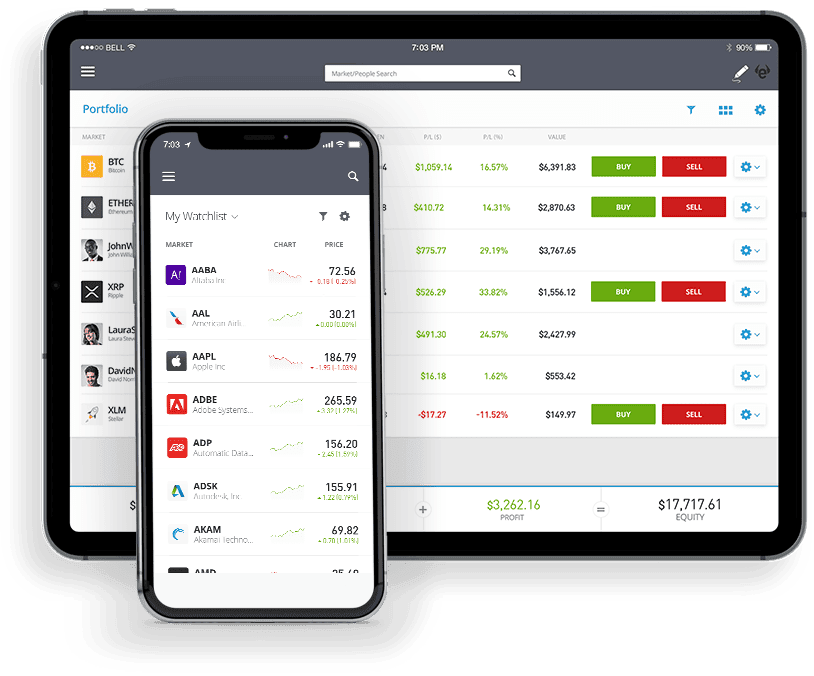

eToro’s trading platform is one of its standout features, offering an intuitive and engaging user experience. The platform is available on both web and mobile devices, ensuring seamless access for traders on the go. Key features of eToro’s trading platform include:

Social Trading: eToro’s flagship feature allows users to follow and copy the trades of successful investors. This not only provides valuable insights but also enables beginners to learn from experienced traders.

User-Friendly Interface: The platform’s interface is designed to be easy to navigate, making it accessible to traders of all experience levels. The dashboard provides a clear overview of portfolio performance, market trends, and trading opportunities.

Charting Tools and Indicators: eToro offers a range of charting tools and technical indicators, enabling traders to perform in-depth market analysis. These tools are essential for developing and executing effective trading strategies.

News Feed and Research: The integrated news feed keeps users informed about the latest market developments, while research tools provide detailed analysis and insights to support trading decisions.

Account Types

eToro offers a variety of account types to cater to different trading needs and preferences. These include:

Retail Account: The standard account type available to most users, offering access to all of eToro’s features, including social trading, a wide range of assets, and educational resources.

Professional Account: Designed for experienced traders who meet certain criteria, the professional account provides higher leverage options and additional benefits, such as reduced fees and personalized support.

Islamic Account: In recognition of the MENA region’s diverse client base, eToro offers an Islamic account that complies with Sharia law. This account type ensures that Muslim traders can participate in financial markets without violating religious principles.

Each account type comes with its own set of features and benefits, allowing traders to choose the one that best suits their individual needs. Additionally, eToro provides a demo account, enabling users to practice trading with virtual funds before committing real money.

Trading Instruments

One of eToro’s standout features is its extensive range of trading instruments. The platform offers a diverse array of assets, catering to both novice and experienced traders. Here are the main categories:

Stocks: eToro provides access to thousands of stocks from major exchanges around the world, including the NYSE, NASDAQ, and LSE. Traders can invest in individual stocks or explore sector-specific options.

Cryptocurrencies: As a pioneer in crypto trading, eToro supports a wide selection of cryptocurrencies such as Bitcoin, Ethereum, Ripple, and many others. The platform is known for its user-friendly interface, making it easier for traders to enter the volatile crypto market.

Forex: Forex trading is another strong suit for eToro. The platform offers a variety of currency pairs, including major, minor, and exotic pairs, providing ample opportunities for forex traders.

Commodities: eToro allows trading in a range of commodities, including gold, silver, oil, and natural gas. This diversity enables traders to hedge against market volatility and diversify their portfolios.

Indices: Traders can also invest in global indices such as the S&P 500, NASDAQ 100, and FTSE 100. These instruments are ideal for those looking to gain exposure to broader market movements.

ETFs: eToro offers a variety of exchange-traded funds (ETFs), which are perfect for traders seeking diversified investment opportunities without buying individual stocks.

Fees and Spreads

Understanding fees and spreads is crucial for traders to manage their costs and maximize returns. eToro is known for its transparent fee structure, but there are several components to consider:

Spreads: eToro primarily earns revenue through spreads, which are the differences between the buy and sell prices of an asset. The spreads on eToro are generally competitive but can vary depending on the asset class. For example, forex spreads can be as low as 1 pip for major currency pairs, while crypto spreads are typically wider due to higher market volatility.

Commission-Free Stock Trading: eToro offers commission-free trading for stocks and ETFs, which is a significant advantage for long-term investors. However, it’s important to note that this applies only to non-leveraged positions.

Overnight Fees: Also known as rollover fees, these are charged for positions held overnight. The fee varies depending on the asset and the direction of the position (buy or sell). eToro provides a detailed breakdown of these fees on their website, ensuring transparency.

Withdrawal Fees: eToro charges a $5 withdrawal fee, which is relatively low compared to other brokers. However, traders should be mindful of potential currency conversion fees if withdrawing in a currency different from their account’s base currency.

Inactivity Fees: An inactivity fee of $10 per month is charged if there is no login activity for 12 months. This fee is deducted from the available balance and does not apply if the account balance is zero.

Pros and Cons

- Commission-Free Stock Trading: eToro’s commission-free trading for stocks and ETFs is a significant advantage, especially for long-term investors.

- Competitive Spreads: The platform offers competitive spreads, particularly for major forex pairs, which can be as low as 1 pip.

- Transparency: eToro provides clear and detailed information about its fees, including overnight and withdrawal fees, ensuring transparency.

- Low Withdrawal Fee: The $5 withdrawal fee is relatively low compared to other brokers, making it more affordable to access funds.

- Wide Crypto Spreads: Spreads for cryptocurrencies tend to be wider, reflecting the higher volatility and risk associated with the crypto market.

- Overnight Fees: Positions held overnight incur rollover fees, which can add up, especially for long-term trades.

- Inactivity Fee: The $10 monthly inactivity fee after 12 months of no login activity can be a drawback for less active traders.

- Potential Currency Conversion Fees: Traders withdrawing in a currency different from their account’s base currency may face additional currency conversion fees.

Leverage Options

Leverage is a powerful tool that allows traders to amplify their positions using borrowed funds. eToro offers varying leverage levels depending on the asset class and the trader’s location, complying with regulatory standards.

Forex Leverage: For forex trading, eToro offers leverage up to 30:1 for major currency pairs and lower leverage for minors and exotics. This means traders can control larger positions with a smaller amount of capital, potentially increasing their profit potential. However, high leverage also comes with increased risk.

Cryptocurrency Leverage: Cryptocurrency trading on eToro is available with leverage up to 2:1, reflecting the high volatility and risk associated with the crypto market. This leverage level is lower compared to other asset classes, which helps to mitigate risk.

Stock Leverage: Leverage for stock trading is available up to 5:1 for non-European clients. European clients are subject to ESMA regulations, which limit leverage to 2:1 for stocks.

Commodity Leverage: Commodities can be traded with leverage up to 10:1, providing traders with the ability to take larger positions in markets like gold, oil, and silver.

Indices Leverage: Indices on eToro can be traded with leverage up to 20:1, allowing traders to gain significant exposure to market movements with a relatively small investment.

Customer Support

Effective customer support is a cornerstone of any reputable broker, and eToro excels in this area, offering a variety of channels through which users can seek assistance.

1. Support Channels:

eToro provides several support channels, including live chat, email support, and a comprehensive Help Center. The live chat feature is particularly beneficial for traders who need immediate assistance. It connects users with a support representative quickly, typically within a few minutes. Email support is also available for less urgent inquiries, with responses usually provided within 24 hours.

2. Quality of Support:

The quality of support offered by eToro is commendable. Support representatives are well-trained and knowledgeable about the platform’s features and services. They can assist with a range of issues, from technical problems to account management and trading queries. Users have reported high satisfaction levels with the professionalism and efficiency of eToro’s customer service team.

3. Community Support:

In addition to direct support channels, eToro offers community support through its active online forum. The eToro Community is a valuable resource where traders can share experiences, ask questions, and get advice from fellow users. This peer support system is particularly useful for new traders who are learning the ropes.

4. Availability:

One area where eToro could improve is the availability of 24/7 customer support. Currently, support is available during market hours, which covers most time zones but may not cater to all traders’ needs, especially those who trade outside regular market hours.

Payment Methods

eToro provides a variety of payment methods to accommodate the diverse preferences of traders in the MENA region.

Deposit Options:

eToro offers multiple deposit options, including credit/debit cards (Visa, MasterCard), bank transfers, and various e-wallets such as PayPal, Skrill, and Neteller. The minimum deposit amount is $200, which is relatively reasonable compared to other brokers. Deposits are generally processed quickly, allowing traders to start trading almost immediately.

Withdrawal Process:

The withdrawal process on eToro is straightforward, but it does come with some fees. Withdrawal requests are typically processed within 1-3 business days. However, the time it takes for the funds to reach the trader’s account can vary depending on the payment method used. Credit/debit card and e-wallet withdrawals are usually faster, while bank transfers can take longer.

Fees:

eToro charges a $5 withdrawal fee, which is relatively low but can add up for frequent withdrawals. Additionally, there may be currency conversion fees if the withdrawal is not in the trader’s base currency. It’s important for traders to be aware of these fees to manage their costs effectively.

Security:

eToro places a high priority on the security of financial transactions. The platform uses advanced encryption technology to protect users’ financial data and complies with international financial regulations. This ensures that traders can deposit and withdraw funds with confidence.

Supported Languages

Given the diverse linguistic landscape of the MENA region, the availability of multiple language options is a significant advantage for eToro.

Language Options: eToro supports a wide range of languages, making it accessible to traders from various backgrounds. The platform is available in Arabic, English, French, German, Italian, Spanish, and more. This multilingual support is crucial for ensuring that traders can navigate the platform and understand its features without language barriers.

Localization: eToro’s commitment to localization goes beyond just language support. The platform also offers localized content, including market analysis and educational resources tailored to specific regions. This is particularly beneficial for MENA traders who can access content relevant to their local markets and trading conditions.

Customer Support in Multiple Languages: Customer support is also available in multiple languages, ensuring that traders can communicate effectively with support representatives in their preferred language. This enhances the overall user experience and makes it easier for traders to resolve any issues they encounter.

Conclusion

eToro stands out as a versatile and innovative broker, particularly well-suited for traders in the MENA region. Its unique social trading platform, coupled with robust regulatory oversight and a comprehensive range of assets, makes it an attractive choice for both beginners and experienced investors. The variety of account types, including the Islamic account, ensures that eToro caters to the diverse needs of its clientele.

By prioritizing security, user engagement, and continuous innovation, eToro has established itself as a trusted and reliable broker in the competitive world of online trading. Whether you are looking to start your trading journey or enhance your existing strategies, eToro offers the tools and resources needed to succeed in the financial markets.

FAQs

Yes, eToro is a fully regulated broker. It operates under the regulations of several major financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

The minimum deposit requirement on eToro varies depending on the country of residence. For most countries, including those in the MENA region, the minimum deposit is $200.

eToro supports a variety of payment methods, including credit/debit cards (Visa, MasterCard), bank transfers, and e-wallets such as PayPal, Skrill, and Neteller.

Deposits on eToro are typically processed instantly or within a few hours, depending on the payment method. Withdrawals usually take 1-3 business days to process, but the total time can vary based on the payment method and the user’s bank.

eToro charges a $5 fee for each withdrawal. Additionally, there may be currency conversion fees if the withdrawal is not in the trader’s base currency. There are no deposit fees, but trading fees and spreads vary by asset.

Yes, eToro provides a free demo account with virtual funds, allowing users to practice trading and familiarize themselves with the platform before investing real money.

eToro offers a web-based trading platform and a mobile app, both of which are user-friendly and packed with features. These platforms provide access to a wide range of financial instruments and social trading features.