- Founded: 1998

- Headquarters: Switzerland

- Min deposit: 1000 USD

- Max Leverage: 1 : 200

Dukascopy is a well-established online brokerage that has gained recognition for its institutional-grade trading environment, advanced trading platforms, and transparent pricing model. Known for its Swiss banking license, Dukascopy appeals to traders seeking a reliable and highly regulated broker with access to a wide range of financial instruments, including forex, CFDs, stocks, and cryptocurrencies.

In this comprehensive review, we will explore Dukascopy’s company background, regulation and safety measures, trading platforms, and account types, helping traders determine whether this broker aligns with their trading needs.

Company Overview

Dukascopy was founded in 2004 in Geneva, Switzerland, and has since grown into one of the most respected brokers in the financial industry. The company is best known for its Swiss banking standards, ensuring a high level of security for client funds.

Dukascopy operates under Dukascopy Bank SA, which is fully licensed as a Swiss bank and adheres to strict financial regulations. Additionally, the broker has expanded globally with its European subsidiary, Dukascopy Europe, offering services to a wider international audience.

The broker specializes in ECN (Electronic Communication Network) trading, providing direct market access with tight spreads and deep liquidity. Dukascopy’s proprietary JForex trading platform is widely regarded for its advanced features, making it a top choice for professional and algorithmic traders.

Dukascopy also offers a range of additional services, including banking solutions, cryptocurrency trading, and a social trading network, further enhancing its appeal among active traders and investors.

Key Facts About Dukascopy

- Founded: 2004

- Headquarters: Geneva, Switzerland

- Regulation: Swiss Financial Market Supervisory Authority (FINMA)

- Trading Platforms: JForex, MetaTrader 4 (MT4)

- Assets: Forex, CFDs, Stocks, Commodities, Cryptocurrencies

- Account Types: Individual, Joint, Corporate, and Islamic accounts

Dukascopy’s reputation as a secure, regulated, and technologically advanced broker has made it a preferred choice for traders worldwide.

Regulation and Safety

Regulation and security are crucial factors when selecting a forex broker, and Dukascopy excels in this area by being a fully licensed Swiss bank.

Regulatory Oversight

Dukascopy is regulated by:

- Swiss Financial Market Supervisory Authority (FINMA) – As a Swiss bank, Dukascopy is required to adhere to strict banking regulations that ensure client fund protection and operational transparency.

- Financial and Capital Market Commission (FCMC) in Latvia – Dukascopy Europe operates under European regulatory oversight, making it compliant with MiFID II regulations.

This dual regulation provides traders with strong financial protection, ensuring that Dukascopy operates with high levels of transparency and reliability.

Client Fund Protection

One of the biggest advantages of trading with Dukascopy is the security of client funds. As a Swiss-regulated bank, Dukascopy must comply with Swiss banking laws, which require strict financial reporting and client fund segregation.

- Client deposits are held in segregated accounts separate from the company’s operational funds.

- Dukascopy provides deposit protection of up to CHF 100,000 under Swiss banking regulations.

Negative Balance Protection

Dukascopy does not offer automatic negative balance protection, meaning traders should use proper risk management strategies when using leverage.

Is Dukascopy Safe?

With strong Swiss banking regulations, segregated client funds, and transparent operations, Dukascopy is considered one of the safest brokers in the forex industry.

Trading Platforms

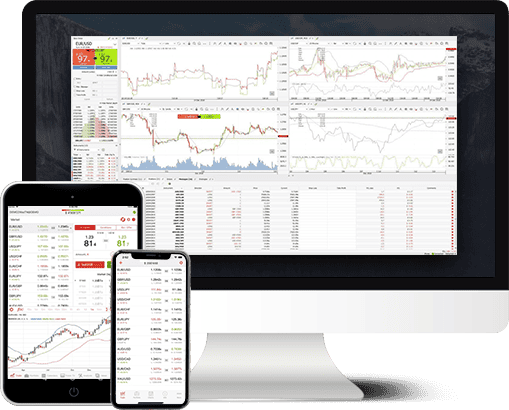

Dukascopy offers a choice of two advanced trading platforms:

JForex 4 – Dukascopy’s Proprietary Platform

JForex 4 is Dukascopy’s flagship trading platform, designed for professional traders, algorithmic traders, and institutions.

Key Features of JForex 4:

- Advanced charting with 270+ technical indicators

- Built-in algorithmic trading capabilities

- Direct ECN market access with deep liquidity

- Customizable user interface and one-click trading

- Web, desktop, and mobile versions available

JForex is particularly popular among traders who prefer automated trading and advanced analytics.

MetaTrader 4 (MT4) – A Standard Option

For traders who prefer a more traditional trading experience, Dukascopy also supports MetaTrader 4 (MT4).

Key Features of MT4:

- User-friendly interface

- Expert Advisors (EAs) for automated trading

- Custom indicators and scripting via MQL4

- Wide range of order execution options

While MT4 remains a popular choice, JForex offers more advanced features, making it the preferred platform for serious traders.

Mobile and Web Trading

Both JForex and MT4 are available on mobile and web, allowing traders to execute trades from anywhere. The mobile apps include real-time price quotes, advanced charting, and instant trade execution.

Which Platform is Best for You?

- For professional traders and algorithmic trading → JForex 4

- For beginners or those familiar with MT4 → MetaTrader 4

Overall, Dukascopy’s trading platforms provide a competitive edge with advanced tools, fast execution speeds, and excellent charting capabilities.

Account Types

Dukascopy offers a variety of account types to cater to different trading needs.

1. Individual Trading Account

The standard individual trading account is suitable for retail traders and provides:

- Access to all trading instruments (forex, CFDs, stocks, commodities, crypto)

- Leverage up to 1:200

- ECN pricing with tight spreads and low commissions

- Minimum deposit of $1,000 for Dukascopy Bank and $100 for Dukascopy Europe

2. Joint Trading Account

A joint account is available for traders who want to manage an account with a partner. This account type is similar to the individual account but allows multiple authorized users.

3. Corporate Trading Account

Businesses and institutions can open a corporate account, which offers:

- Tailored trading solutions

- Higher liquidity and custom pricing models

- Dedicated account managers

4. Islamic (Swap-Free) Account

For traders who require Sharia-compliant trading, Dukascopy offers an Islamic account, which operates without interest charges (swaps).

5. Managed Accounts (PAMM)

Dukascopy also provides a PAMM (Percentage Allocation Management Module) account for investors who prefer to have their funds managed by professional traders.

Which Account Type is Best for You?

For retail traders → Individual Account

For partnerships → Joint Account

For businesses → Corporate Account

For Islamic traders → Swap-Free Account

For passive investing → Managed Account (PAMM)

Trading Instruments

Dukascopy offers a wide range of trading instruments, catering to both retail and institutional traders. The broker provides access to forex, CFDs, indices, commodities, stocks, and cryptocurrencies, ensuring a diverse portfolio for traders looking to diversify their strategies.

Forex Trading

Dukascopy is well known for its competitive forex trading conditions, offering ECN pricing with deep liquidity. Traders can access over 60 currency pairs, including major, minor, and exotic pairs.

- Major Pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF

- Minor Pairs: EUR/GBP, AUD/NZD, CAD/JPY

- Exotic Pairs: USD/TRY, EUR/ZAR, GBP/MXN

The low spreads and fast execution speeds make Dukascopy a preferred choice for scalpers and high-frequency traders.

CFDs on Indices and Commodities

Dukascopy offers Contracts for Difference (CFDs) on major indices and commodities, allowing traders to speculate on market movements without owning the underlying assets.

- Stock Indices: S&P 500, Dow Jones, NASDAQ 100, FTSE 100, DAX 40, Nikkei 225

- Commodities: Gold, Silver, Crude Oil (Brent & WTI), Natural Gas

These instruments allow traders to take long or short positions on global markets, benefiting from leverage and margin trading.

Stock CFDs

Dukascopy provides stock CFDs on some of the world’s largest companies, including:

- Tech Stocks: Apple, Amazon, Google, Microsoft

- Banking & Finance: JPMorgan, Goldman Sachs, Bank of America

- Energy & Industrials: ExxonMobil, Tesla, Boeing

Trading stock CFDs allows traders to speculate on price movements without owning shares, while benefiting from low commissions and leverage.

Cryptocurrency Trading

Dukascopy also offers cryptocurrency CFDs, allowing traders to participate in the growing crypto market. Some of the available crypto pairs include:

- Bitcoin (BTC/USD)

- Ethereum (ETH/USD)

- Ripple (XRP/USD)

- Litecoin (LTC/USD)

Cryptocurrency CFDs allow traders to capitalize on crypto volatility without needing a crypto wallet or direct ownership of digital assets.

Metals and Bonds

Dukascopy provides access to precious metals trading, including gold, silver, platinum, and palladium, as well as government bonds for traders looking for lower-risk investment opportunities.

Which Trading Instruments Are Best for You?

Forex traders will appreciate tight spreads and deep liquidity.

Stock and index traders can use Dukascopy’s CFDs for short-term trading.

Crypto traders can benefit from Dukascopy’s regulated and secure trading environment.

Commodity traders can access gold, silver, and oil markets with leverage.

Fees and Spreads

Dukascopy is known for its transparent fee structure, offering competitive spreads and low commissions. Unlike market-maker brokers, Dukascopy uses an ECN model, providing direct market access with real-time pricing from liquidity providers.

Spreads

Dukascopy offers floating spreads that vary based on market conditions.

- EUR/USD: As low as 0.1 pips

- GBP/USD: Starts from 0.5 pips

- USD/JPY: Starts from 0.2 pips

- Gold (XAU/USD): Starts from 0.2 pips

Since Dukascopy operates an ECN pricing model, spreads tend to be tight during liquid trading hours but may widen during periods of low liquidity.

Commission Fees

Unlike brokers that make money through wider spreads, Dukascopy charges a commission based on trading volume. The commission rate depends on account type, trading volume, and equity balance.

- For forex trading: Starting at $3.50 per lot per side

- For CFDs on indices, stocks, and commodities: Fees vary based on instrument

- For crypto CFDs: Commission fees are higher due to volatility

Deposit and Withdrawal Fees

- Deposits: Most funding methods are free, but some bank transfers may incur fees.

- Withdrawals: Bank wire withdrawals can cost between $20 and $50, depending on the currency and bank location.

Inactivity Fees

Dukascopy charges an inactivity fee of $40 per year if an account is inactive for more than one year.

Pros and Cons

- Tight ECN Spreads – Spreads on major forex pairs start as low as 0.1 pips, offering cost-efficient trading.

- Transparent Pricing Model – Dukascopy operates on a commission-based ECN model, ensuring real-time market prices.

- Low Commissions for Active Traders – Traders with high trading volumes benefit from discounted commission rates.

- No Hidden Markups – Unlike some brokers, Dukascopy does not artificially widen spreads to generate profits.

- Competitive Forex Trading Fees – Forex traders enjoy low overall costs compared to many market-maker brokers.

- Commission-Based Fee Structure – While spreads are tight, traders must pay a per-lot commission, which can add to trading costs.

- Higher Costs for Low-Volume Traders – Traders with small account sizes or low trading volumes may find the commission fees relatively high.

- Wider Spreads on Some CFDs – Stock and commodity CFDs may have higher spreads compared to specialized CFD brokers.

- Inactivity Fee – Accounts inactive for more than a year are subject to a $40 annual fee.

- Withdrawal Fees Apply – Bank withdrawals may incur fees ranging from $20 to $50, depending on the method and currency.

Leverage Options

Leverage is a crucial aspect of trading, allowing traders to control larger positions with a relatively small amount of capital. Dukascopy provides flexible leverage options, catering to different types of traders based on their location, experience level, and asset class. The broker follows strict regulatory requirements, ensuring that leverage levels remain within risk-managed limits to protect traders from excessive exposure.

Leverage for Forex Trading

Forex traders at Dukascopy benefit from variable leverage that depends on their trading region and account type. For international traders who qualify, leverage can go as high as 1:200, meaning they can control a position 200 times the size of their deposit. However, for traders operating under European (ESMA) regulations, leverage is restricted to 1:30 for retail accounts to comply with financial safety standards.

Professional traders who meet specific eligibility criteria may apply for higher leverage limits, reaching up to 1:400 in some cases. While high leverage provides an opportunity for amplified gains, it also increases the risk of significant losses, making risk management an essential part of trading with leverage.

Leverage for CFD Trading

In addition to forex, Dukascopy offers leverage for Contracts for Difference (CFDs) across a variety of asset classes. Stock CFDs generally have lower leverage, typically around 1:10, while index CFDs and commodity CFDs can reach up to 1:50, depending on market conditions and the specific asset being traded.

Dukascopy’s leverage structure for CFDs allows traders to engage in both long and short positions on global markets, with the ability to adjust exposure based on their risk tolerance. However, due to market volatility, leverage may be dynamically adjusted to mitigate extreme price fluctuations.

Leverage for Cryptocurrency Trading

Trading cryptocurrencies involves significantly higher volatility than traditional forex or stocks, and as a result, Dukascopy applies lower leverage limits to crypto CFDs. Traders can access leverage of up to 1:5 on major cryptocurrencies, such as Bitcoin (BTC/USD), Ethereum (ETH/USD), and Ripple (XRP/USD). This ensures that traders are not excessively exposed to the wild price swings that are common in the crypto market.

Margin Requirements and Risk Management

Dukascopy follows a margin-based trading system, meaning that traders must maintain a sufficient account balance to support their leveraged positions. If a trader’s margin level falls below a certain threshold, a margin call may be triggered, requiring additional funds to maintain the open positions. If no additional margin is provided, positions may be liquidated automatically to prevent further losses.

The stop-out level at Dukascopy is set at 50%, meaning that if a trader’s available margin falls to 50% or below, their positions will be closed automatically to protect against further negative exposure. Traders should carefully monitor their margin levels and adjust position sizes accordingly to avoid forced liquidation.

Customer Support

Dukascopy offers comprehensive customer support designed to meet the needs of traders across different time zones and regions. As a Swiss-regulated broker, it prioritizes professionalism, efficiency, and responsiveness in handling client inquiries.

Availability and Contact Methods

Dukascopy provides 24/6 customer support, meaning traders can reach out for assistance at almost any time of the week except Sundays. The broker offers multiple ways for clients to get in touch, ensuring that they receive prompt responses.

- Live Chat – Available directly on the Dukascopy website and trading platforms, providing real-time assistance from customer service representatives.

- Phone Support – Traders can contact regional support teams in different countries, including Switzerland, Latvia, Hong Kong, Japan, and the UAE.

- Email Support – Clients can send queries via email for more detailed support on account issues, trading conditions, or technical assistance.

- FAQ Section – Dukascopy has an extensive Help Center and FAQ section, addressing common questions about trading platforms, funding, regulation, and more.

Response Time and Customer Experience

Dukascopy’s customer support is known for being highly professional and well-trained, with quick response times, particularly via live chat and phone support. Traders have reported that most queries are resolved efficiently, especially those related to account setup, deposit processing, and trading platform navigation.

However, some users have noted that email response times can be slower, particularly during peak trading hours or for complex inquiries. Additionally, while 24/6 support is beneficial, the lack of 24/7 availability may be inconvenient for traders who need urgent assistance outside of market hours.

Payment Methods

Dukascopy supports a variety of payment methods for funding and withdrawing from trading accounts. As a fully licensed Swiss bank, the broker follows strict regulatory policies to ensure secure transactions while maintaining compliance with anti-money laundering (AML) standards.

Deposit Methods

Dukascopy allows traders to deposit funds using several convenient methods:

- Bank Wire Transfer – The most widely used deposit method, supporting multiple currencies. Processing time typically takes 1-3 business days, depending on the bank and location.

- Credit/Debit Cards (Visa, MasterCard, Maestro) – Provides instant deposits for traders who need quick access to funds.

- Cryptocurrency Deposits (Bitcoin, Ethereum, USDT, etc.) – Dukascopy allows crypto deposits, converting digital assets into fiat currency for trading purposes.

- Skrill and Neteller – Popular e-wallets for fast and efficient funding.

- Internal Transfers – Clients who hold multiple accounts with Dukascopy can transfer funds internally between their accounts.

Minimum Deposit Requirements:

- Dukascopy Bank requires a minimum deposit of $1,000 for trading accounts.

- Dukascopy Europe offers a lower minimum deposit of $100, making it more accessible for retail traders.

Withdrawal Methods

Withdrawals are processed through the same methods used for deposits, ensuring consistency and security.

- Bank Wire Withdrawals – The most common withdrawal method, typically processed within 1-3 business days.

- Credit/Debit Card Withdrawals – Available for traders who originally deposited via card, though processing times may vary.

- Cryptocurrency Withdrawals – Available for traders looking to withdraw in digital assets.

- E-wallet Withdrawals – Skrill and Neteller offer fast withdrawal processing compared to traditional bank transfers.

Fees and Processing Times

Dukascopy maintains transparent payment processing fees, but some methods incur additional charges:

- Deposits via bank wire may have third-party banking fees.

- Withdrawals via bank wire range from $20 to $50, depending on currency and bank.

- E-wallet and crypto transactions may have lower fees but can vary based on the provider.

Supported Languages

Dukascopy serves a global client base, and as a result, the broker provides support in multiple languages to ensure accessibility for traders from different regions.

Languages Available for Customer Support

The broker’s live chat, phone, and email support are available in English, French, German, Spanish, Russian, Arabic, Chinese, Japanese, and more. The availability of support in different languages depends on the regional customer service center handling the request.

For instance:

- English, French, and German support is available through the Swiss headquarters.

- Russian and Latvian support is managed by Dukascopy Europe.

- Arabic support is available for traders in MENA regions.

- Japanese and Chinese support is provided through the Asia-Pacific office.

Platform and Website Language Support

Dukascopy’s JForex trading platform, MetaTrader 4, and the official website are available in multiple languages, including:

- English

- French

- German

- Spanish

- Italian

- Russian

- Arabic

- Chinese (Simplified and Traditional)

- Japanese

- Portuguese

- Turkish

This multilingual approach ensures that traders from different backgrounds can navigate the platform, read trading materials, and communicate with support teams in their preferred language.

Conclusion

Dukascopy is a Swiss-regulated broker known for its institutional-grade trading environment, tight ECN spreads, and advanced JForex 4 platform. Its direct market access, strong security, and wide range of tradable instruments make it a top choice for experienced and professional traders.

The low-cost ECN pricing and deep liquidity benefit high-volume traders, scalpers, and algorithmic traders. However, commission-based fees, high minimum deposits ($1,000 for Dukascopy Bank), and no guaranteed negative balance protection may not suit beginners or casual traders.

Who Should Trade with Dukascopy?

- Professional traders needing low spreads and fast execution.

- Algorithmic traders using JForex 4 for automated strategies.

- Forex and CFD traders who want direct market access and Swiss security.

Final Verdict

Dukascopy is one of the most secure and technologically advanced brokers, ideal for serious traders who value low-cost ECN pricing and advanced trading tools. While its complex fee structure and high deposit requirements may not suit everyone, for experienced traders, Dukascopy remains a top-tier choice in 2025.

FAQs

Yes, Dukascopy is fully regulated by the Swiss Financial Market Supervisory Authority (FINMA) as a Swiss bank. Its European branch, Dukascopy Europe, is regulated by the Financial and Capital Market Commission (FCMC) in Latvia, ensuring compliance with MiFID II regulations.

Dukascopy offers its proprietary JForex 4 trading platform, designed for professional and algorithmic traders. It also supports MetaTrader 4 (MT4) for those who prefer a more traditional trading experience. However, MetaTrader 5 (MT5) is not available.

The minimum deposit for Dukascopy Bank SA (Switzerland) is $1,000, while Dukascopy Europe requires only $100, making it more accessible for retail traders.

Dukascopy provides several account types, including Individual, Joint, Corporate, Islamic (swap-free), and Managed (PAMM) accounts.

No, Dukascopy does not provide guaranteed negative balance protection. Traders should manage risk carefully, as high leverage can lead to losses exceeding the initial deposit.

Leverage varies based on regulations:

- Retail EU traders: Maximum 1:30 (due to ESMA restrictions).

- International traders: Up to 1:200.

- Professional traders: Can apply for leverage up to 1:400.

- Cryptocurrency CFDs: Limited to 1:5 due to high volatility.

Dukascopy offers a diverse range of trading instruments, including:

- Forex: Over 60 currency pairs.

- CFDs: Stocks, indices, commodities, and bonds.

- Cryptocurrency CFDs: Bitcoin, Ethereum, Ripple, and more.