- Founded: 2007

- Headquarters: South Africa

- Min deposit: 300 USD

- Max Leverage: 1 : 500

DBG Markets is a prominent brokerage firm offering trading services in the MENA region. This review provides an in-depth analysis of DBG Markets, covering its features, fees, trading platforms, customer support, and overall performance. Our goal is to help you determine whether DBG Markets is the right broker for your trading needs.

Company Overview

DBG Markets has established itself as a reliable broker in the MENA region, offering a wide range of financial instruments, including forex, commodities, indices, and stocks. The broker is known for its user-friendly platforms, competitive spreads, and comprehensive educational resources, making it suitable for both beginners and experienced traders.

Regulation and Safety

One of the paramount concerns for any trader is the safety and regulatory compliance of their chosen broker. DBG Markets takes this aspect seriously, ensuring that its clients’ funds and trading activities are protected under stringent regulatory frameworks.

Regulatory Status

DBG Markets is regulated by several reputable authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. These regulatory bodies are known for their rigorous standards and strict oversight, providing a high level of security and transparency for traders.

Client Fund Protection

To further enhance client safety, DBG Markets employs segregation of client funds. This means that client money is kept in separate accounts, distinct from the broker’s operational funds. In the unlikely event of the broker’s insolvency, client funds remain protected and are not used to pay off creditors.

Insurance Coverage

Additionally, DBG Markets offers insurance coverage for its clients through the Investor Compensation Fund (ICF) in Cyprus and the Financial Services Compensation Scheme (FSCS) in the UK. These schemes provide an extra layer of protection, ensuring that clients are compensated up to a certain amount if the broker fails to meet its financial obligations.

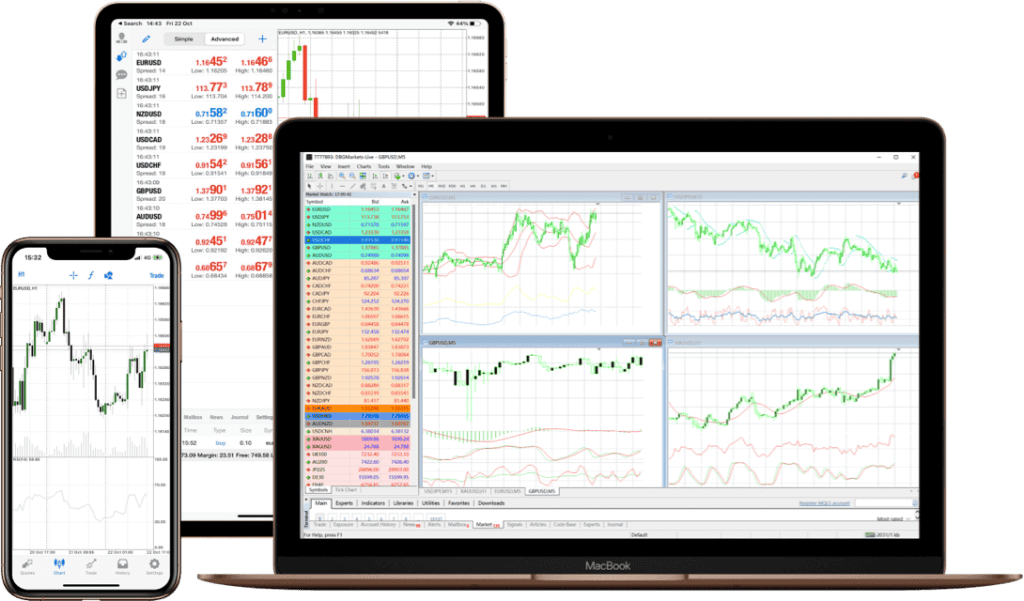

Trading Platforms

DBG Markets provides a robust suite of trading platforms designed to meet the needs of both novice and experienced traders. Each platform offers a range of features that enhance the trading experience.

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms in the world, and DBG Markets offers it with full support. MT4 is known for its user-friendly interface, advanced charting tools, and a wide array of technical indicators. It also supports automated trading through Expert Advisors (EAs), allowing traders to implement and test their trading strategies efficiently.

MetaTrader 5 (MT5)

For those seeking more advanced features, MetaTrader 5 is available. MT5 offers all the functionalities of MT4 along with additional timeframes, an integrated economic calendar, and enhanced order management capabilities. This platform is ideal for traders who require more detailed market analysis and sophisticated trading options.

WebTrader

DBG Markets also provides a WebTrader platform, which offers the flexibility of trading directly from any web browser without the need to download or install software. The WebTrader platform maintains most of the functionalities of MT4 and MT5, making it a convenient option for traders on the go.

Mobile Trading

Understanding the need for mobility, DBG Markets has developed mobile trading apps for both iOS and Android devices. These apps offer full trading capabilities, real-time market data, and the ability to manage accounts and execute trades from anywhere, ensuring that traders can stay connected to the markets at all times.

Account Types

DBG Markets caters to a wide range of traders by offering multiple account types, each designed to meet specific trading needs and preferences.

Standard Account: The Standard Account is ideal for beginner traders. It requires a relatively low minimum deposit and offers competitive spreads. This account type provides access to all the major markets and is equipped with basic tools and resources necessary for trading.

Pro Account: For more experienced traders, the Pro Account offers tighter spreads and lower commission rates. This account type requires a higher minimum deposit and provides enhanced trading conditions, including faster execution speeds and access to a broader range of financial instruments.

VIP Account: The VIP Account is designed for high-net-worth individuals and professional traders who demand the best trading conditions. It offers the tightest spreads, lowest commissions, and priority customer support. VIP account holders also receive personalized trading advice and access to exclusive market insights.

Islamic Account: Understanding the unique needs of traders in the MENA region, DBG Markets offers Islamic Accounts that comply with Sharia law. These accounts are swap-free, meaning they do not incur interest charges on overnight positions, making them suitable for Muslim traders who adhere to Islamic financial principles.

Trading Instruments

DBG Markets stands out for its extensive range of trading instruments, catering to both novice and experienced traders. The broker offers access to multiple markets, including:

- Forex: With over 50 currency pairs, DBG Markets provides ample opportunities for Forex traders. Major, minor, and exotic pairs are all available, allowing traders to diversify their strategies and take advantage of global market movements.

- Commodities: Traders can access a variety of commodities, including precious metals like gold and silver, energy resources such as oil and natural gas, and agricultural products like wheat and coffee. This variety enables traders to hedge against inflation and market volatility.

- Indices: DBG Markets offers trading on major global indices, including the S&P 500, NASDAQ, FTSE 100, and DAX 30. These indices provide traders with a broad view of market performance and the opportunity to trade on economic trends.

- Stocks: The broker provides access to a wide selection of global stocks from major exchanges, including the NYSE, NASDAQ, and LSE. Traders can invest in well-known companies across various sectors, from technology and healthcare to finance and consumer goods.

- Cryptocurrencies: For those interested in the rapidly growing crypto market, DBG Markets offers trading in popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This allows traders to capitalize on the high volatility and potential returns of digital assets.

Fees and Spreads

One of the most critical aspects for traders is the cost of trading, and DBG Markets excels in offering competitive fees and tight spreads.

- Spreads: DBG Markets provides tight spreads, especially on major currency pairs and popular indices. For instance, spreads on the EUR/USD pair can be as low as 0.8 pips, making it an attractive option for Forex traders. The spreads on commodities and indices are also competitive, ensuring that traders can maximize their profits.

- Commission Fees: The broker follows a no-commission model for most of its trading instruments, which is a significant advantage for traders looking to minimize their costs. For stocks and some commodities, a small commission may apply, but it is generally lower than industry averages.

- Overnight Fees: Like most brokers, DBG Markets charges overnight fees (swap rates) for positions held overnight. These fees are transparent and can be reviewed in the trading platform, allowing traders to manage their positions effectively.

- Deposit and Withdrawal Fees: DBG Markets does not charge any fees for deposits or withdrawals, which is a considerable benefit for traders. The broker supports various payment methods, including bank transfers, credit/debit cards, and popular e-wallets like PayPal and Skrill, providing flexibility and convenience.

Pros and Cons

- Tight Spreads: DBG Markets offers tight spreads, especially on major currency pairs and popular indices. For instance, spreads on the EUR/USD pair can be as low as 0.8 pips, making it an attractive option for Forex traders.

- No Commission on Most Instruments: The broker follows a no-commission model for most of its trading instruments, which significantly reduces the cost of trading.

- Transparency: All fees, including overnight fees (swap rates), are transparent and can be reviewed within the trading platform.

- Free Deposits and Withdrawals: DBG Markets does not charge any fees for deposits or withdrawals, providing added convenience and cost savings for traders.

- Variety of Payment Methods: The broker supports various payment methods, including bank transfers, credit/debit cards, and popular e-wallets like PayPal and Skrill.

- Commission on Some Instruments: While most trading instruments are commission-free, there are small commission fees on some stocks and commodities, which might be a drawback for traders focusing on these assets.

- Overnight Fees: Like most brokers, DBG Markets charges overnight fees for positions held overnight, which can add up if positions are held for extended periods.

- Potential for Wider Spreads in Volatile Markets: During periods of high market volatility, spreads can widen, increasing trading costs temporarily.

Leverage Options

Leverage is a crucial factor for many traders, as it allows them to control larger positions with a smaller amount of capital. DBG Markets offers flexible leverage options tailored to different trading instruments and trader profiles.

Forex Leverage: For Forex trading, DBG Markets offers leverage up to 1:500. This high leverage ratio can significantly amplify profits, but it also increases the potential risk, making it essential for traders to use it wisely.

Commodities and Indices Leverage: The leverage for commodities and indices typically ranges from 1:100 to 1:200. This range provides sufficient leverage to enhance trading opportunities while maintaining a balanced risk level.

Stock Leverage: Leverage for stock trading is generally lower, usually around 1:20 to 1:50. This lower leverage reflects the higher stability and lower volatility of stocks compared to Forex or commodities.

Cryptocurrency Leverage: Given the volatile nature of cryptocurrencies, DBG Markets offers more conservative leverage options, typically up to 1:10. This approach helps manage the substantial risks associated with crypto trading.

Customer Support

Customer support is a cornerstone of any successful brokerage, and DBG Markets excels in this area. The broker offers 24/7 customer service, ensuring that traders can access assistance whenever they need it. This around-the-clock support is particularly beneficial for traders in the MENA region, who may need help at different times due to varied trading hours and market activities.

Support Channels

DBG Markets provides multiple channels for customer support, including live chat, email, and phone support. The live chat feature is particularly noteworthy for its quick response times and efficiency. Users can expect to connect with a support agent within minutes, which is crucial for resolving urgent trading issues. Email support is also reliable, with responses typically received within 24 hours. For more personalized assistance, phone support is available, and agents are well-trained to handle a range of inquiries from technical issues to account management.

Quality of Support

The quality of customer support at DBG Markets is impressive. Support agents are knowledgeable and professional, providing clear and concise answers to queries. They are well-versed in the platform’s features and can offer detailed guidance on navigating the trading tools, managing accounts, and executing trades. Additionally, the broker offers a comprehensive FAQ section and a range of educational resources on their website, which can help users troubleshoot common issues on their own.

User Experience

Feedback from users indicates a high level of satisfaction with DBG Markets’ customer support. Many traders appreciate the promptness and effectiveness of the service, highlighting the professionalism and courteous nature of the support staff. The multilingual support options also ensure that traders from various linguistic backgrounds receive assistance in their preferred language, enhancing the overall user experience.

Payment Methods

DBG Markets offers a variety of payment methods to cater to the diverse needs of traders in the MENA region. This flexibility ensures that users can easily deposit and withdraw funds, making the trading experience smooth and efficient.

Deposit Methods

DBG Markets supports several deposit methods, including bank transfers, credit/debit cards, and popular e-wallets such as PayPal, Skrill, and Neteller. Bank transfers are a preferred option for many traders due to their reliability and security. Credit and debit card deposits are processed instantly, allowing traders to start trading without delay. E-wallets offer a convenient alternative, with fast processing times and low transaction fees.

Withdrawal Methods

When it comes to withdrawals, DBG Markets maintains the same level of flexibility and efficiency. Withdrawals can be made via bank transfers, credit/debit cards, and e-wallets. The processing times for withdrawals are generally swift, with e-wallet withdrawals often completed within 24 hours, while bank transfers and credit card withdrawals may take a few business days. This prompt processing is crucial for traders who need quick access to their funds.

Fees and Limits

DBG Markets is transparent about its fees and limits, ensuring traders are well-informed before making transactions. There are no hidden fees for deposits, and the broker covers most of the transaction costs, especially for larger deposits. Withdrawal fees are also competitive, with minimal charges applied to e-wallet withdrawals. The broker provides clear information on minimum and maximum deposit and withdrawal limits, which vary depending on the chosen method.

Supported Languages

DBG Markets understands the importance of catering to a diverse clientele, particularly in the linguistically varied MENA region. The broker supports multiple languages, ensuring that traders can access the platform and support services in their preferred language.

Platform Languages

The DBG Markets trading platform is available in several languages, including English, Arabic, French, and Turkish. This multilingual support makes the platform accessible to a wider audience, allowing traders to navigate the site and use its features with ease. The translation quality is high, ensuring that all information is accurately conveyed, which is essential for making informed trading decisions.

Customer Support Languages

Customer support is also available in multiple languages. Traders can receive assistance in English, Arabic, French, and Turkish, among others. This multilingual support is a significant advantage, as it allows traders to communicate more effectively and receive help in their native language. It also reflects DBG Markets’ commitment to providing inclusive and comprehensive services to all its clients.

Conclusion

DBG Markets stands out as a reliable and comprehensive broker in the MENA region, offering a wide range of assets, user-friendly platforms, and competitive spreads. Its commitment to education and robust customer support make it an excellent choice for both novice and experienced traders. While the fees are transparent and reasonable, the broker’s regulation and security measures provide additional peace of mind. Whether you are just starting your trading journey or looking for a new broker, DBG Markets is worth considering.

FAQs

DBG Markets offers a variety of account types, including Standard, Premium, and VIP accounts. Each account type caters to different levels of trading experience and investment amounts, with varying benefits such as lower spreads and dedicated account managers.

To open an account, visit the DBG Markets website, click on the “Open Account” button, and fill out the registration form. You’ll need to provide some personal information and complete the KYC verification process.

For account verification, you will need to provide a government-issued ID (passport, driver’s license, or national ID) and proof of address (utility bill or bank statement not older than three months).

Yes, DBG Markets offers a demo account that allows you to practice trading with virtual funds. This is an excellent way to familiarize yourself with the platform and test your trading strategies without risking real money.

DBG Markets supports various deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets such as PayPal, Skrill, and Neteller.

Withdrawal times vary depending on the method used. E-wallet withdrawals are typically processed within 24 hours, while bank transfers and credit/debit card withdrawals may take a few business days.

DBG Markets offers a range of trading platforms, including the popular MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary web-based platform. These platforms are available on both desktop and mobile devices.