- Founded: 2006

- Headquarters: Ireland

- Min deposit: 100 USD

- Max Leverage: 1 : 400

AvaTrade is a prominent name in the online trading world, especially known for its strong presence in the MENA region. With over a decade of experience, AvaTrade has carved out a reputation for providing a robust trading platform, a diverse range of assets, and top-notch customer service. This review delves into the key aspects of AvaTrade, including its company overview, regulation and safety, trading platforms, and account types, to help you determine if this broker aligns with your trading needs.

Company Overview

Founded in 2006, AvaTrade has grown into a global entity with over 300,000 registered traders worldwide. Headquartered in Dublin, Ireland, the broker operates offices across major cities, including Tokyo, Milan, Sydney, and Paris, to better serve its international clientele. AvaTrade offers a comprehensive range of trading instruments, including forex, stocks, commodities, cryptocurrencies, indices, and bonds, catering to both novice and experienced traders.

One of the standout features of AvaTrade is its commitment to education. The broker provides extensive resources, including webinars, eBooks, video tutorials, and one-on-one training sessions, making it an excellent choice for beginners who wish to learn the intricacies of trading.

Regulation and Safety

AvaTrade prioritizes the safety and security of its clients’ funds and personal information. The broker is regulated by several top-tier financial authorities, ensuring that it adheres to strict regulatory standards and practices. These regulatory bodies include:

- Central Bank of Ireland (CBI)

- Australian Securities and Investments Commission (ASIC)

- Financial Services Agency (FSA) in Japan

- Financial Sector Conduct Authority (FSCA) in South Africa

- Financial Futures Association of Japan (FFAJ)

- Abu Dhabi Global Markets (ADGM) in the UAE

Being regulated by multiple reputable authorities means that AvaTrade must comply with stringent rules regarding client fund segregation, anti-money laundering policies, and regular audits. This multi-jurisdictional oversight provides an added layer of security and trust for traders, particularly those in the MENA region.

Additionally, AvaTrade offers negative balance protection, ensuring that clients cannot lose more than their initial investment, and compensates eligible clients through investor compensation schemes in the unlikely event of insolvency.

Trading Platforms

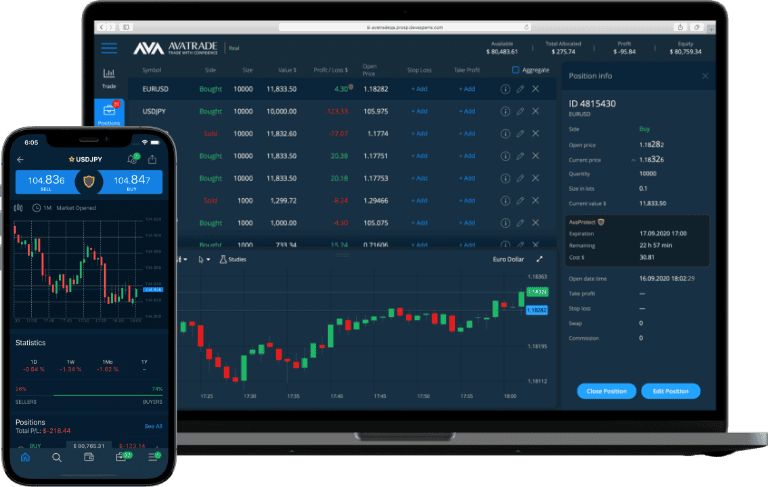

AvaTrade stands out for offering a variety of trading platforms, each designed to cater to different trading styles and preferences. Here’s a closer look at the platforms available:

AvaTradeGO: This is AvaTrade’s proprietary mobile app, providing a user-friendly interface with advanced trading features. It’s designed for traders who prefer to trade on the go and offers real-time market data, one-click trading, and detailed charting tools.

MetaTrader 4 (MT4): MT4 is one of the most popular trading platforms globally, known for its robust features and reliability. AvaTrade’s MT4 platform includes automated trading capabilities through Expert Advisors (EAs), advanced charting tools, and a wide range of technical indicators.

MetaTrader 5 (MT5): An upgrade to MT4, the MT5 platform offers additional features such as more timeframes, an economic calendar, and improved charting tools. It’s ideal for traders looking for an enhanced trading experience.

AvaOptions: This platform is tailored for those interested in options trading. AvaOptions allows traders to trade forex options with a variety of strategies, providing flexibility and control over trading decisions.

WebTrader: For traders who prefer not to download software, AvaTrade’s WebTrader platform offers a seamless trading experience directly from any web browser. It provides access to all the trading instruments and features available on the downloadable platforms.

ZuluTrade and DupliTrade: These social trading platforms allow traders to follow and copy the trades of experienced investors. It’s a great way for beginners to learn from seasoned professionals and for advanced traders to diversify their strategies.

Account Types

AvaTrade offers a range of account types to cater to different trader needs and experience levels:

Standard Account: The most popular choice among traders, the Standard Account requires a minimum deposit of $100. It offers competitive spreads, leverage up to 1:400, and access to all trading instruments and platforms.

Demo Account: Ideal for beginners, the Demo Account allows traders to practice and hone their skills with virtual funds. It replicates real market conditions without the risk of losing actual money.

Islamic Account: Designed specifically for traders in the MENA region, the Islamic Account complies with Sharia law by eliminating interest (swap) charges on overnight positions. This account offers the same features as the Standard Account but adheres to Islamic financial principles.

Professional Account: For experienced traders who meet certain criteria, the Professional Account offers higher leverage (up to 1:400) and tighter spreads. To qualify, traders must have significant trading experience and meet specific financial criteria.

Retail Account: This account is suitable for everyday traders and offers competitive spreads, negative balance protection, and access to all trading platforms and instruments.

VIP Account: High-net-worth individuals and frequent traders can opt for the VIP Account, which provides personalized customer service, lower spreads, and other premium features.

Trading Instruments

AvaTrade offers an extensive selection of trading instruments, catering to traders of all levels and preferences. Here’s a detailed breakdown of the available assets:

Forex Trading: AvaTrade provides access to over 50 currency pairs, including majors, minors, and exotics. This extensive range allows traders to capitalize on various market opportunities, whether they are looking to trade popular pairs like EUR/USD or explore less common pairs for higher volatility.

Commodities: For those interested in commodities trading, AvaTrade offers a robust selection, including precious metals like gold and silver, energy products such as oil and natural gas, and agricultural commodities like wheat and coffee. This variety allows traders to diversify their portfolios and hedge against market volatility.

Indices: AvaTrade gives traders the opportunity to trade on the performance of major global indices, such as the S&P 500, NASDAQ, FTSE 100, and DAX 30. Trading indices can be an excellent way to gain exposure to a broader market rather than individual stocks.

Stocks and ETFs: Stock traders can access a wide array of shares from leading markets, including tech giants like Apple and Google, as well as emerging market stocks. Additionally, AvaTrade offers ETFs (Exchange-Traded Funds), providing a convenient way to invest in a basket of assets.

Cryptocurrencies: AvaTrade is at the forefront of cryptocurrency trading, offering a range of popular digital currencies such as Bitcoin, Ethereum, Ripple, and Litecoin. The broker supports both long and short positions, allowing traders to profit from market fluctuations.

Options and Bonds: For more advanced trading strategies, AvaTrade also offers options trading and a selection of bonds. This provides traders with additional tools to manage risk and enhance their portfolios.

Fees and Spreads

AvaTrade is known for its competitive fee structure, which is a critical factor for traders aiming to maximize their profits. Below, we explore the key aspects of their fees and spreads:

Spreads: AvaTrade primarily earns through spreads, which are the difference between the bid and ask prices. The broker offers both fixed and variable spreads. For major currency pairs like EUR/USD, spreads can be as low as 0.9 pips under normal market conditions. This is quite competitive, especially for retail traders who are looking to keep their trading costs low.

Commissions: One of the notable advantages of AvaTrade is its commission-free trading on most assets. Unlike some brokers that charge a commission per trade, AvaTrade’s fee structure is built into the spreads. This can be particularly beneficial for high-frequency traders who would otherwise incur significant commission costs.

Overnight Fees: Traders holding positions overnight should be aware of AvaTrade’s swap or rollover fees, which are charged based on the interest rate differential between the two currencies in a forex pair or the cost of holding other asset types. These fees are standard in the industry but can vary depending on the asset and market conditions.

Inactivity Fees: AvaTrade charges an inactivity fee of $50 per quarter after three consecutive months of inactivity. While this fee is not uncommon among brokers, active traders typically do not need to worry about it. However, it’s an important consideration for those who may not trade frequently.

Pros and Cons

- Competitive Spreads: AvaTrade offers low spreads, especially for major currency pairs like EUR/USD, which can be as low as 0.9 pips under normal market conditions. This is beneficial for traders looking to minimize trading costs.

- Commission-Free Trading: AvaTrade does not charge commissions on most of its assets, as the fee structure is built into the spreads. This can be particularly advantageous for high-frequency traders who might otherwise incur significant commission costs.

- Transparency: The broker provides clear information about its spreads and fees, ensuring that traders understand the costs involved in their trades.

- Overnight Fees: AvaTrade charges swap or rollover fees for positions held overnight. While these fees are standard in the industry, they can add up over time, particularly for long-term traders.

- Inactivity Fees: An inactivity fee of $50 per quarter is charged after three consecutive months of inactivity. This can be a drawback for traders who do not trade frequently.

- Variable Spreads: While fixed spreads provide predictability, variable spreads can widen during periods of high market volatility, potentially increasing trading costs unexpectedly.

Leverage Options

Leverage is a crucial aspect of trading, allowing traders to amplify their positions and potential profits. AvaTrade offers generous leverage options, though it’s essential to use leverage wisely as it also increases the potential for significant losses.

Forex Leverage

AvaTrade provides leverage of up to 400:1 for forex trading. This high leverage means that with just $1,000, traders can control a position worth $400,000. While this can lead to substantial gains, it also carries a high level of risk, and traders should employ effective risk management strategies.

CFDs and Commodities Leverage

For CFDs (Contracts for Difference) and commodities, AvaTrade offers leverage of up to 200:1. This level of leverage is competitive and allows traders to maximize their exposure to various markets without requiring substantial capital.

Cryptocurrency Leverage

Cryptocurrency trading with AvaTrade comes with a leverage of up to 20:1. Given the volatile nature of the cryptocurrency markets, this leverage is relatively high, providing traders with the opportunity to capitalize on market movements while maintaining manageable risk levels.

Stocks and Indices Leverage

Leverage for stocks is available up to 20:1, while for indices, it can go up to 200:1. These leverage options enable traders to diversify their investments and take advantage of market trends across different asset classes.

Customer Support

Customer support is a critical factor when choosing a broker, and AvaTrade excels in this area. The broker offers 24/5 customer service, ensuring that traders can get assistance whenever the markets are open. This is particularly beneficial for traders in the MENA region who may need support during different time zones.

Availability and Channels

AvaTrade provides multiple channels for customer support, including:

- Live Chat: The live chat feature is available on the AvaTrade website, allowing for real-time assistance. This is one of the fastest ways to get help, as responses are typically immediate.

- Email Support: For less urgent queries or more detailed issues, traders can email AvaTrade’s support team. The response time is generally within 24 hours.

- Phone Support: AvaTrade offers phone support with dedicated lines for different regions, including a local number for the MENA region. This ensures that traders can speak to a support representative in their own language and time zone.

- FAQ and Help Center: AvaTrade’s website features an extensive FAQ section and a help center with articles covering a wide range of topics. This can be a valuable resource for finding quick answers to common questions.

Quality of Support

The quality of support provided by AvaTrade is generally high. Support representatives are knowledgeable and professional, capable of handling various issues ranging from technical problems with the trading platform to inquiries about account management and trading strategies. AvaTrade also offers support in multiple languages, which is a significant advantage for traders in the diverse MENA region.

Payment Methods

AvaTrade supports a wide range of payment methods, making it convenient for traders to deposit and withdraw funds. This flexibility is particularly important in the MENA region, where preferred payment methods can vary widely.

Deposit Methods

AvaTrade offers several options for depositing funds into your trading account, including:

- Credit/Debit Cards: Visa, MasterCard, and other major credit and debit cards are accepted. This method is instant, allowing you to start trading almost immediately.

- Bank Transfers: For larger deposits, bank transfers are available. While this method is secure, it can take a few days for the funds to be credited to your account.

- E-Wallets: AvaTrade supports popular e-wallets such as PayPal, Neteller, and Skrill. E-wallet deposits are typically processed instantly, offering a quick and convenient option.

Withdrawal Methods

Withdrawals can be made using the same methods as deposits, ensuring consistency and convenience. Withdrawal requests are usually processed within 24-48 hours, although the time it takes for the funds to reach your account can vary depending on the method used.

Fees and Limits

AvaTrade does not charge deposit fees, which is a great advantage for traders. Withdrawal fees vary depending on the method, but they are generally reasonable. It’s important to note that while AvaTrade strives to keep fees low, your payment provider may charge additional fees, so it’s always good to check with them beforehand.

Supported Languages

AvaTrade is a global broker with a strong presence in the MENA region, and it recognizes the importance of language support in providing a seamless trading experience. The broker supports multiple languages, ensuring that traders from different backgrounds can access their services without language barriers.

Website and Platform Languages

The AvaTrade website and trading platform are available in several languages, including:

- Arabic: This is particularly important for traders in the MENA region, allowing them to navigate the platform and access resources in their native language.

- English: As a global language, English is widely supported and provides a common ground for international traders.

- Other Languages: AvaTrade also supports languages such as French, Spanish, German, Italian, and more, catering to its diverse client base.

Customer Support Languages

Customer support is available in multiple languages, reflecting AvaTrade’s commitment to accessibility. In the MENA region, Arabic and English are the primary languages of support, ensuring that traders can communicate effectively with support representatives.

Conclusion

AvaTrade is a well-established broker with a strong presence in the MENA region, offering a secure and regulated trading environment. Its diverse range of trading platforms and account types caters to various trading styles and preferences, making it a suitable choice for both novice and experienced traders. With a commitment to education, excellent customer support, and robust regulatory oversight, AvaTrade stands out as a reliable partner for anyone looking to navigate the financial markets with confidence.

FAQs

AvaTrade is a leading online broker offering a wide range of trading services, including forex, commodities, stocks, cryptocurrencies, and more. Established in 2006, AvaTrade is regulated by several financial authorities globally and is known for its comprehensive trading platforms and excellent customer support.

Yes, AvaTrade is regulated by several prominent financial authorities, including:

- Central Bank of Ireland

- ASIC (Australian Securities and Investments Commission)

- FSA (Financial Services Agency) in Japan

- FSCA (Financial Sector Conduct Authority) in South Africa

- ADGM (Abu Dhabi Global Market) Financial Regulatory Services Authority in the UAE

These regulations ensure that AvaTrade operates transparently and adheres to strict financial standards.

AvaTrade offers several types of trading accounts to suit different needs:

- Standard Account: Ideal for individual traders.

- Islamic Account: Swap-free accounts for traders who comply with Sharia law.

- Demo Account: A practice account that allows traders to test the platform and strategies without risking real money.

- Professional Account: For experienced traders who meet specific criteria, offering higher leverage and other benefits.

AvaTrade supports a variety of payment methods for deposits and withdrawals, including:

- Credit/Debit Cards: Visa, MasterCard, and more.

- Bank Transfers: Suitable for larger transactions, though processing times may vary.

- E-Wallets: PayPal, Neteller, Skrill, and others for fast and convenient transactions.

Deposits are usually processed instantly, while withdrawals may take 1-2 business days to process.

AvaTrade does not charge any deposit fees. However, there may be withdrawal fees depending on the payment method used. Additionally, traders should be aware of potential inactivity fees if their account is inactive for a prolonged period.

Yes, AvaTrade offers a range of cryptocurrencies for trading, including Bitcoin, Ethereum, Litecoin, and more. Traders can benefit from leverage, competitive spreads, and the ability to trade both long and short positions.

AvaTrade is suitable for traders of all experience levels. The platform provides extensive educational resources, a user-friendly interface, and a demo account for practice. These features make it an excellent choice for beginners looking to learn and develop their trading skills.