- Founded: 2011

- Headquarters: UAE

- Min deposit: 100 USD

- Max Leverage: 1 : 500

In the dynamic world of trading, choosing the right broker is crucial for achieving success. ADSS, also known as ADS Securities, stands out as a leading brokerage firm in the MENA region. With its comprehensive range of services, innovative trading platforms, and exceptional customer support, ADSS offers a robust trading environment that caters to both novice and experienced traders. In this review, we will explore the key strengths of ADSS that make it a premier choice for traders in the MENA region.

Company Overview

Founded in 2011 and headquartered in Abu Dhabi, ADSS (ADS Securities) is a highly reputed brokerage firm regulated by the Central Bank of the UAE. This regulatory oversight ensures that the broker adheres to the highest standards of security and transparency. With additional offices in London and Hong Kong, ADSS not only has a strong local presence but also extends its services globally, offering a diverse range of trading opportunities. The broker provides access to a wide variety of financial instruments, including forex, commodities, indices, equities, and cryptocurrencies. This extensive selection enables traders to diversify their portfolios and leverage different market opportunities effectively.

ADSS is committed to delivering a seamless trading experience through its state-of-the-art trading platforms and superior customer service. The broker’s approach is characterized by a blend of advanced technology and personalized support, catering to the unique needs of traders in the MENA region and beyond. This combination of global reach and local expertise makes ADSS a standout choice for those looking to navigate the complexities of the financial markets with confidence.

Regulation and Safety

One of the most critical aspects of any brokerage is its regulatory status and the safety measures it implements to protect its clients. ADSS excels in this area, ensuring a secure trading environment for its users.

Regulatory Compliance

ADSS is regulated by multiple prestigious authorities, which is a testament to its credibility and reliability. The broker is authorized and regulated by the Central Bank of the UAE, the Financial Conduct Authority (FCA) in the UK, and the Securities and Futures Commission (SFC) in Hong Kong. This multi-jurisdictional regulation ensures that ADSS adheres to stringent financial standards and practices, offering clients peace of mind regarding the safety of their funds.

Client Fund Protection

ADSS takes the safety of client funds seriously. It employs segregated accounts to keep client funds separate from its own operational funds. This means that even in the unlikely event of the broker facing financial difficulties, client funds remain protected and accessible. Furthermore, being under the purview of top-tier regulators like the FCA means that clients are also covered by compensation schemes, adding an extra layer of financial security.

Robust Security Measures

ADSS implements advanced security protocols to safeguard client data and transactions. The broker uses state-of-the-art encryption technology to protect sensitive information, ensuring that all online transactions are secure. Additionally, ADSS regularly undergoes security audits and assessments to stay ahead of potential threats, maintaining a safe trading environment.

Trading Platforms

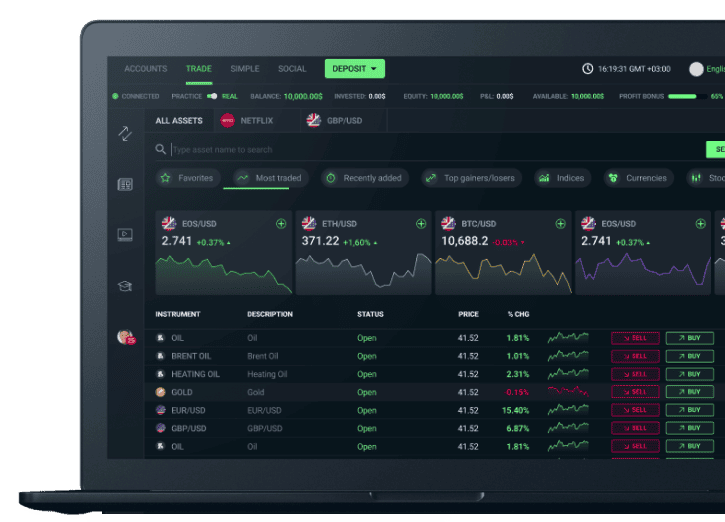

ADSS offers a range of trading platforms designed to cater to the varying needs of traders, from beginners to seasoned professionals.

- MetaTrader 4 (MT4): MetaTrader 4 is one of the most popular trading platforms globally, and ADSS provides full access to it. MT4 is known for its user-friendly interface, making it an excellent choice for both novice and experienced traders. The platform offers a wide array of technical analysis tools, customizable charts, and automated trading capabilities through Expert Advisors (EAs). This makes MT4 a versatile platform that can adapt to different trading styles and strategies.

- Ooredoo Trading Platform: In addition to MT4, ADSS offers its proprietary Ooredoo Trading Platform. This platform is designed to provide a seamless trading experience with advanced features and functionalities. It offers intuitive navigation, real-time market data, and comprehensive charting tools. The Ooredoo Trading Platform is available on both desktop and mobile devices, allowing traders to manage their accounts and execute trades on the go.

- Trading Tools and Resources: ADSS enhances its trading platforms with a suite of tools and resources aimed at improving the trading experience. These include economic calendars, market analysis reports, and educational materials. The broker also offers demo accounts, allowing traders to practice and hone their skills without risking real money.

Account Types

ADSS understands that different traders have different needs, which is why it offers a variety of account types to cater to a diverse clientele.

Classic Account: The Classic Account is designed for retail traders who are just starting out. It has a low minimum deposit requirement, making it accessible to a broad audience. This account type offers competitive spreads and access to all the major asset classes, including forex, commodities, indices, and cryptocurrencies. The Classic Account also provides full access to the broker’s trading platforms and resources, ensuring that beginners have all the tools they need to succeed.

Elite Account: The Elite Account is tailored for more experienced traders and those who require premium features. It offers tighter spreads, lower commission rates, and priority customer support. This account type also includes access to advanced trading tools and exclusive market insights. The higher minimum deposit requirement reflects the premium nature of the services provided, catering to traders who demand a more sophisticated trading experience.

Swap-Free Account: Understanding the diverse needs of traders in the MENA region, ADSS offers a Swap-Free Account that complies with Islamic finance principles. This account type allows traders to engage in forex and other asset classes without incurring overnight swap fees, making it ideal for those who observe Sharia law. The Swap-Free Account maintains the same features and benefits as the Classic Account, ensuring that Islamic traders do not miss out on any trading opportunities.

Trading Instruments

One of the most significant advantages of trading with ADSS is the wide variety of trading instruments available to clients. ADSS offers access to a diverse range of markets, ensuring that traders can find opportunities that suit their trading styles and strategies. Here’s a closer look at the primary trading instruments offered:

- Forex: ADSS provides access to over 60 currency pairs, including major, minor, and exotic pairs. This extensive selection allows traders to capitalize on currency movements around the clock.

- Commodities: Traders can diversify their portfolios by trading popular commodities such as gold, silver, oil, and natural gas. Commodities trading is available with competitive spreads and flexible contract sizes.

- Indices: ADSS offers trading on major global indices, including the FTSE 100, S&P 500, and NASDAQ. This allows traders to speculate on the overall performance of a particular market or economy.

- Equities: For those interested in stock trading, ADSS provides access to shares from major global markets. This includes blue-chip stocks from the US, Europe, and Asia, enabling traders to invest in some of the world’s leading companies.

- Cryptocurrencies: In response to the growing popularity of digital currencies, ADSS has included a selection of cryptocurrencies such as Bitcoin, Ethereum, and Ripple. This allows traders to engage with the burgeoning cryptocurrency market.

- Treasuries and Bonds: ADSS also offers trading in government and corporate bonds, providing a safer investment option for more risk-averse traders.

Fees and Spreads

ADSS is highly competitive when it comes to fees and spreads, which is a crucial factor for traders seeking to maximize their profits. Here’s a breakdown of the cost structure:

Spreads: ADSS offers tight spreads, starting as low as 0.8 pips for major currency pairs like EUR/USD. The low spreads make it cost-effective for traders to enter and exit positions, enhancing their overall profitability.

Commission Fees: One of the major benefits of trading with ADSS is that there are no commission fees on Forex and CFD trades. This zero-commission model is particularly advantageous for high-frequency traders who can save significantly on trading costs.

Account Fees: ADSS does not charge any deposit or withdrawal fees, which further reduces the cost burden on traders. Additionally, there are no hidden charges, and the broker is transparent about any potential costs.

Swap Rates: For traders who hold positions overnight, ADSS offers competitive swap rates. These rates are clearly listed on the platform, ensuring transparency and allowing traders to factor these costs into their trading strategies.

Minimum Deposit: The minimum deposit requirement at ADSS is $100, making it accessible to both novice traders and those with smaller trading budgets.

Pros and Cons

- Tight Spreads: ADSS offers competitive spreads, starting as low as 0.8 pips for major currency pairs, which can enhance overall profitability.

- No Commission Fees: Zero commission on Forex and CFD trades is highly beneficial for high-frequency traders, reducing overall trading costs.

- No Deposit/Withdrawal Fees: The absence of fees for deposits and withdrawals adds to the cost-effectiveness of trading with ADSS.

- Transparency: Clear listing of swap rates and no hidden charges ensure transparency in trading costs.

- Variable Spreads: While spreads are competitive, they can vary depending on market conditions, which might affect trading costs during periods of high volatility.

- Swap Rates: Overnight holding costs might be higher for some instruments, impacting long-term positions.

Leverage Options

Leverage is a critical component of trading, and ADSS offers flexible leverage options to cater to different trading styles and risk appetites. Here’s how ADSS handles leverage:

Forex Leverage: ADSS offers leverage up to 500:1 for Forex trading, allowing traders to control larger positions with a relatively small amount of capital. This high leverage is ideal for experienced traders who can manage the associated risks effectively.

Indices and Commodities Leverage: For indices and commodities, the leverage offered is up to 200:1. This provides ample opportunity for traders to amplify their gains while maintaining a manageable level of risk.

Equities Leverage: Leverage for equity trading varies depending on the market, but generally, ADSS offers up to 20:1 leverage on major stocks. This allows traders to take significant positions in leading companies without committing large amounts of capital upfront.

Cryptocurrency Leverage: ADSS provides leverage of up to 4:1 on cryptocurrency trades. While this is lower compared to other asset classes, it reflects the higher volatility and risk associated with digital currencies.

Customer Support

One of the standout features of ADSS is its excellent customer support. Recognizing the importance of prompt and effective assistance, ADSS offers a comprehensive support system designed to address traders’ needs efficiently.

Availability and Accessibility

ADSS provides 24/5 customer support, ensuring that help is available during market hours. This round-the-clock availability is crucial for traders who may encounter issues or have questions during trading sessions. Whether it’s early morning or late at night, ADSS’s support team is ready to assist.

Multiple Contact Channels

Traders can reach ADSS’s customer support through various channels, including live chat, email, and phone. The live chat feature is particularly popular for its quick response time, allowing traders to get real-time assistance without long waiting periods. Additionally, the phone support option is available for those who prefer speaking directly with a representative, providing a personal touch to the service.

Professional and Knowledgeable Staff

The quality of support provided by ADSS is top-notch. The support staff are well-trained, professional, and knowledgeable about the trading platform and financial markets. They can assist with a wide range of issues, from technical problems to trading strategies. This level of expertise ensures that traders receive accurate and helpful information, enhancing their overall trading experience.

Payment Methods

ADSS offers a variety of payment methods, making it convenient for traders to fund their accounts and withdraw their profits. This flexibility is essential for accommodating the diverse needs and preferences of traders in the MENA region.

Deposit Options: Traders can choose from multiple deposit options, including bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. This variety ensures that traders can select the most convenient method for them, facilitating a smooth and hassle-free funding process.

Withdrawal Process: The withdrawal process at ADSS is straightforward and efficient. Withdrawals are typically processed within 1-3 business days, depending on the chosen method. This quick turnaround time is beneficial for traders who need timely access to their funds. Additionally, ADSS does not charge any fees for withdrawals, which is a significant advantage compared to some other brokers that impose high fees for this service.

Security and Reliability: Security is a top priority for ADSS, and this is evident in their payment processing protocols. The broker uses advanced encryption technology to protect financial transactions, ensuring that traders’ funds and personal information are safe. This commitment to security provides traders with peace of mind, knowing that their money is in trustworthy hands.

Supported Languages

ADSS is committed to serving the diverse MENA region by offering support in multiple languages. This multilingual support is a critical feature that makes ADSS accessible and user-friendly for traders from various backgrounds.

Arabic Language Support

Given its base in Abu Dhabi, ADSS naturally provides extensive support in Arabic. This includes the website interface, customer support, and educational resources. Arabic-speaking traders can navigate the platform and seek assistance in their native language, making the trading experience more comfortable and intuitive.

English Language Support

In addition to Arabic, ADSS offers full support in English. This includes the trading platform, customer service, and educational materials. English is widely spoken in the financial industry, and ADSS’s bilingual support ensures that it can cater to a broad audience, including expatriates and international traders in the MENA region.

Additional Languages

While Arabic and English are the primary languages supported, ADSS also provides assistance in other languages upon request. This flexibility demonstrates the broker’s commitment to inclusivity and customer satisfaction, accommodating the linguistic needs of its diverse clientele.

Conclusion

ADSS is a top-tier broker in the MENA region, offering a comprehensive trading environment characterized by advanced platforms, a diverse range of financial instruments, excellent customer support, and a strong regulatory framework. The broker’s commitment to providing a seamless trading experience and investing in trader education sets it apart from its competitors.

Whether you are a beginner looking to enter the world of trading or an experienced trader seeking a reliable and versatile broker, ADSS is an excellent choice. With its innovative platforms, extensive market access, and unwavering commitment to customer satisfaction, ADSS provides the tools and support necessary to achieve trading success.

FAQs

Yes, ADSS is regulated by the Central Bank of the UAE. This regulation ensures that ADSS adheres to strict financial and operational standards, providing traders with a secure and trustworthy trading environment.

ADSS provides access to the industry-standard MetaTrader 4 (MT4) platform and its proprietary OREX platform. Both platforms are designed to cater to the needs of traders at all levels, offering a range of tools and features to enhance the trading experience.

ADSS offers a variety of payment methods, including bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. This diversity allows traders to choose the most convenient method for funding their accounts and withdrawing their profits.

Withdrawals at ADSS are typically processed within 1-3 business days, depending on the chosen method. ADSS does not charge any fees for withdrawals, making it a cost-effective option for traders.

Yes, ADSS is committed to empowering its traders through education. The broker offers a wide range of educational resources, including webinars, tutorials, and market analysis, all available in multiple languages. These resources help traders enhance their knowledge and improve their trading skills.

ADSS’s main strengths include its excellent customer support, diverse payment methods, multilingual assistance, advanced trading platforms, and commitment to security and regulation. These features make ADSS a top choice for traders in the MENA region.

Yes, ADSS offers mobile trading through its platforms, allowing traders to access their accounts and trade on the go. The mobile platforms provide the same range of features and tools as the desktop versions, ensuring a seamless trading experience across devices.