- Founded: 1996

- Headquarters: Canada

- Min deposit: 1 USD

- Max Leverage: 1 : 200

OANDA is a well-established name in the world of online trading and forex brokerage. With over two decades of experience, OANDA has built a solid reputation for providing transparent services, competitive pricing, and access to a wide range of trading instruments. Whether you’re a beginner or an experienced trader, OANDA aims to cater to all types of clients by offering robust trading platforms, a wealth of educational resources, and exceptional customer support.

In this review, we’ll take a deep dive into OANDA by examining its company background, regulatory status, safety measures, and available trading platforms, so you can better understand whether this broker suits your trading needs.

Company overview

OANDA was founded in 1996 in the U.S. by Dr. Stumm and Dr. Olsen, with a primary focus on currency data and analytics. Over the years, it evolved into one of the most trusted forex and CFD brokers, known for transparency and offering institutional-grade solutions to retail traders. It serves clients worldwide with a strong presence in markets like North America, Europe, Asia, and Australia.

One of OANDA’s key strengths lies in its innovation. The broker was one of the first to offer free online currency conversion tools and eventually became a pioneer in offering forex trading to retail customers. Today, OANDA offers a wide variety of financial instruments, including forex, commodities, indices, bonds, and metals.

OANDA has also received various accolades for its reliability and trading conditions. It provides tight spreads, no minimum deposit requirements, and easy account management, making it appealing to both small-scale and large-scale traders.

Regulation and Safety

Regulation and safety are crucial factors for traders when selecting a broker. OANDA excels in this regard by operating under stringent regulatory oversight in multiple jurisdictions. This adds a layer of trust and security for traders, ensuring that their funds are protected and the broker adheres to high industry standards.

OANDA is regulated by several top-tier financial authorities, which include:

- U.S. Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA).

- Financial Conduct Authority (FCA) in the UK.

- Australian Securities and Investment Commission (ASIC).

- Monetary Authority of Singapore (MAS).

- Investment Industry Regulatory Organization of Canada (IIROC).

These regulatory bodies enforce strict rules around capital requirements, client fund segregation, transparency, and reporting, ensuring that clients’ funds are safe. OANDA’s operations are subject to regular audits, and it also offers negative balance protection in certain jurisdictions, which helps protect traders from losing more than their deposited amount.

Additionally, client funds are held in segregated accounts, separate from the company’s operating funds. This ensures that in the unlikely event of insolvency, clients’ funds remain intact. OANDA also utilizes advanced encryption technologies to ensure that clients’ personal and financial data is protected from cyber threats.

Trading Platforms

OANDA offers a range of trading platforms tailored to suit different kinds of traders, from novices to professionals. The broker places a strong emphasis on user experience, ensuring that their platforms are easy to navigate while being packed with advanced features for more experienced traders.

Here’s a closer look at OANDA’s platform offerings:

OANDA’s Web-Based Trading Platform

OANDA’s proprietary web platform is known for its simplicity and functionality. It is ideal for both new traders looking for an intuitive interface and experienced traders who require fast execution speeds. The platform offers all the essential tools needed for trading and charting, including customizable charts, technical analysis tools, and real-time price feeds. Users can easily access their accounts from any web browser, making it accessible across devices.MetaTrader 4 (MT4)

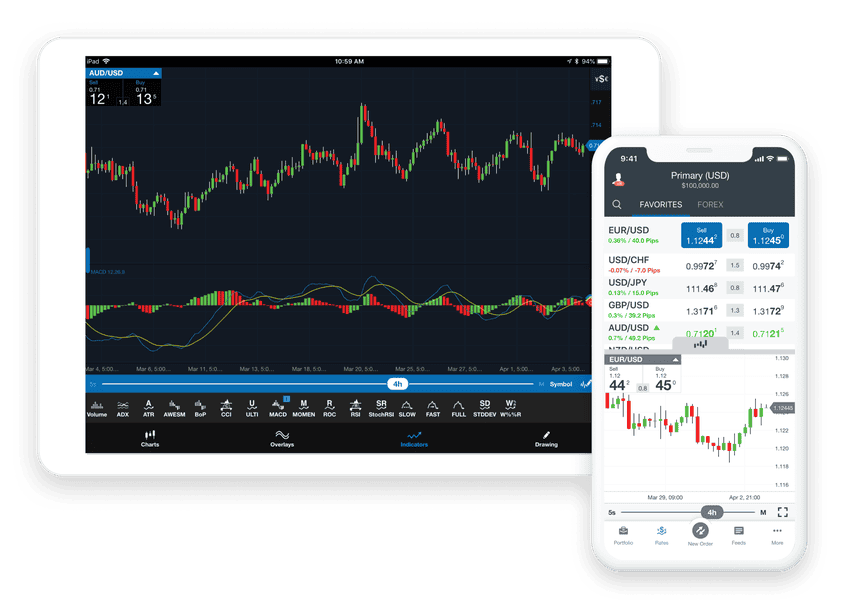

MetaTrader 4 is one of the most popular trading platforms globally, and OANDA offers full support for it. MT4 is highly favored by seasoned traders due to its advanced technical analysis tools, automated trading options (Expert Advisors or EAs), and a wide range of indicators. OANDA enhances the MT4 experience with low-latency execution and deep liquidity, ensuring fast trade execution even in volatile market conditions.OANDA’s Mobile Trading App

OANDA’s mobile trading platform is available for both Android and iOS devices, ensuring traders can manage their trades on the go. The app is designed for a seamless trading experience and offers many of the same functionalities as the desktop and web versions. Features include one-click trading, charting, live pricing, and risk management tools.Advanced Charting Tools

OANDA integrates with TradingView, a well-known charting service that provides robust tools for technical analysis. Traders can create, customize, and save charts with a wide array of indicators and drawing tools. This makes it a great platform for those who rely on in-depth chart analysis to make trading decisions.API Trading

For advanced traders and institutions looking for automation and custom trading systems, OANDA provides access to its REST and FIX APIs. These APIs allow traders to develop custom trading applications, perform algorithmic trading, and access OANDA’s pricing, liquidity, and trade execution infrastructure directly.

Account Types

OANDA offers two primary types of trading accounts for its clients: the Standard Account and the Premium Account.

Standard Account:

- The Standard Account is ideal for new traders or those with moderate trading volumes.

- It offers access to OANDA’s full range of products, including forex, indices, commodities, bonds, and cryptocurrencies.

- There are no minimum deposit requirements, making it accessible to traders with varying levels of capital. This is a significant advantage for those who prefer to start small and scale up their investments gradually.

- The account includes flexible lot sizes, allowing traders to open positions as small as 0.01 lots (micro-lots), which is particularly beneficial for risk management.

Premium Account:

- The Premium Account is designed for high-volume traders who can meet a minimum deposit requirement, often around $20,000.

- In addition to all the features of the Standard Account, Premium Account holders receive enhanced customer support, priority service, and access to advanced analytical tools.

- Traders also benefit from lower trading costs, including tighter spreads and reduced commissions, which can be a key advantage for frequent traders.

- Premium account holders are given a dedicated relationship manager, adding a layer of personalized service for more sophisticated trading strategies.

Demo Account:

- OANDA also provides a demo account, which is highly beneficial for beginners who want to practice trading with virtual funds before transitioning to live trading. The demo account offers access to all of OANDA’s platforms and products, allowing users to familiarize themselves with the broker’s environment without risking real capital.

Trading Instruments

OANDA offers a broad range of trading instruments, allowing traders to diversify their portfolios across multiple asset classes. This makes OANDA suitable for both short-term speculators and long-term investors looking to balance risk.

Forex:

- OANDA is perhaps best known for its forex trading offering. It provides access to over 70 currency pairs, including major, minor, and exotic pairs. With tight spreads and a transparent pricing model, forex traders can expect competitive costs.

- One of OANDA’s unique selling points is its proprietary currency converter tool, which can be useful for traders looking to analyze exchange rates or forecast trends in the forex market.

Indices:

- OANDA offers CFDs (Contracts for Difference) on global indices, providing exposure to the performance of major stock markets around the world. Some of the popular indices available include the S&P 500, FTSE 100, and Nikkei 225.

- Index trading can be an efficient way for traders to speculate on the broader market rather than individual stocks, and OANDA’s competitive pricing ensures it remains an attractive option.

Commodities:

- Traders on OANDA can also access a wide range of commodity markets, including metals (gold, silver), energy (oil, natural gas), and agricultural products (wheat, corn).

- This selection makes it easier for traders to diversify and hedge their portfolios based on global economic trends or geopolitical events.

Cryptocurrencies:

- Although primarily a forex broker, OANDA has entered the cryptocurrency market, allowing clients to trade popular digital assets such as Bitcoin, Ethereum, and Litecoin through CFDs. This enables crypto trading without the need to own the underlying assets, providing exposure to the rapidly evolving digital currency market.

Bonds:

- OANDA also offers bond CFDs, allowing traders to speculate on the price movements of government bonds. This can provide a lower-risk alternative to equities and commodities, especially during times of market uncertainty.

Fees and Spreads

OANDA has a transparent pricing structure, and one of its key selling points is the lack of hidden fees.

Spreads:

- OANDA uses variable spreads, which fluctuate depending on market conditions. On major forex pairs like EUR/USD, spreads can go as low as 1.1 pips during times of high liquidity. However, during periods of market volatility or low liquidity, spreads can widen significantly.

- Traders can choose between two pricing models: a spread-only model, where costs are included in the spread, or a core pricing model, which offers tighter spreads with an additional commission.

Commissions:

- OANDA does not charge a commission on its spread-only accounts. However, traders using the core pricing model will incur a small commission, which starts at $40 per million traded. This model is more suitable for high-volume traders who benefit from lower spreads and are willing to pay a commission.

Non-Trading Fees:

- OANDA does not charge deposit fees, and withdrawal fees vary depending on the method. For example, bank wire withdrawals may carry a fee, while credit card withdrawals are often free.

- An inactivity fee applies if an account has no trading activity for 12 months. The fee is around $10 per month but only applies to accounts with positive balances.

Pros and Con

- Transparent Pricing Structure: OANDA has a clear and transparent fee structure with no hidden charges, which is particularly appealing for traders who prioritize cost-efficiency.

- No Commission on Spread-Only Accounts: Traders using OANDA’s spread-only model are not charged any commissions, as the cost is built into the spread, simplifying the cost calculation.

- Tight Spreads on Major Pairs: OANDA offers competitive spreads on major currency pairs such as EUR/USD, with spreads starting as low as 1.1 pips during periods of high liquidity.

- Choice Between Pricing Models: Traders can choose between a spread-only model or a core pricing model (tighter spreads + commission), giving flexibility based on their trading style and volume.

- No Deposit Fees: OANDA does not charge any fees for deposits, making it easier for traders to fund their accounts without incurring extra costs.

- Variable Spreads Can Widen: While spreads can be tight during liquid market conditions, they can widen significantly during periods of volatility or low liquidity, potentially increasing trading costs.

- Commission on Core Pricing Model: Although the core pricing model offers tighter spreads, it comes with an additional commission fee (starting at $40 per million traded), which may increase costs for smaller traders.

- Inactivity Fee: OANDA charges a $10 monthly inactivity fee after 12 months of no trading activity. This can be a drawback for traders who don’t trade frequently.

- Withdrawal Fees: Depending on the withdrawal method, traders may incur fees (e.g., bank wire transfers), which can add up, particularly for smaller accounts.

- Higher Costs for Non-Major Pairs and Instruments Spreads on minor or exotic forex pairs, as well as other instruments like commodities or cryptocurrencies, can be higher compared to major forex pairs, making trading these instruments more expensive.

Leverage Options

OANDA provides leverage to its traders, allowing them to increase their market exposure without committing the full value of a trade upfront. The leverage offered varies based on the asset class and the trader’s region due to regulatory restrictions.

Forex Leverage:

- In most regions, OANDA offers leverage of up to 50:1 on major forex pairs, meaning traders can control positions up to 50 times the amount of their initial margin. However, the leverage ratio may be lower in regions like Europe or Australia, where regulations limit leverage to 30:1 for retail traders to protect them from high risk.

- Professional clients can apply for higher leverage levels if they meet specific criteria, which can be beneficial for experienced traders who are comfortable with increased risk.

Leverage on Other Instruments:

- For indices and commodities, leverage typically ranges from 10:1 to 20:1, depending on the market. Cryptocurrency CFDs often come with lower leverage, typically around 2:1, reflecting the high volatility of these assets.

- OANDA also offers negative balance protection for retail clients, ensuring that traders do not lose more than their initial deposit even when trading with leverage.

Customer Support

Customer support is a critical aspect of any online broker, and OANDA delivers well in this area. The broker provides multiple channels of communication, ensuring that clients can receive timely assistance whenever they need it.

24/5 Live Support:

OANDA’s customer support team is available 24 hours a day, five days a week, aligning with the global forex market’s operating hours. Traders can contact the support team via live chat, email, or phone. The live chat feature is particularly useful for resolving urgent issues, and users often report that the response time is fast and the representatives are knowledgeable.Comprehensive Help Section:

OANDA’s website features a comprehensive help section that covers a wide range of topics. From account management to trading platforms and technical support, the help section is a valuable resource for traders who prefer self-service. It also includes FAQs, video tutorials, and detailed guides on various aspects of trading.Multilingual Support:

To cater to its global clientele, OANDA offers multilingual support in several languages. This is particularly beneficial for non-English speaking traders who may require assistance in their native language. The availability of multilingual support enhances the overall customer experience and makes OANDA accessible to a broader audience.

Payment Methods

OANDA supports a variety of payment methods, making it easy for clients to deposit and withdraw funds from their trading accounts. The broker ensures that payment processing is quick and secure, adhering to regulatory standards to protect client funds.

Bank Transfers:

One of the most common payment methods supported by OANDA is bank transfers. Traders can deposit funds directly from their bank accounts into their OANDA trading account. Bank transfers are a secure option, but they may take a few business days to process, depending on the bank and the country of origin.Credit and Debit Cards:

OANDA accepts major credit and debit cards, including Visa and MasterCard. Deposits made via credit or debit cards are usually processed instantly, allowing traders to start trading almost immediately. However, some banks may charge additional fees for using this payment method.Electronic Wallets:

OANDA also supports a range of popular electronic wallets, such as PayPal and Skrill. E-wallets offer a fast and convenient way to fund your trading account, with most transactions being processed within minutes. This option is particularly attractive for traders who prefer not to use traditional banking methods.Withdrawals:

Withdrawals from OANDA accounts are typically processed through the same method used for deposits. The processing time for withdrawals varies depending on the payment method, with bank transfers taking the longest (up to five business days) and electronic wallets being the fastest (within 24 hours).

Supported Languages

OANDA has a global presence, and its platform is available in multiple languages to cater to its diverse clientele. The broker supports the following languages:

- English: The default language of OANDA’s platform, website, and customer support.

- Spanish: For traders based in Spain, Latin America, and other Spanish-speaking regions.

- French: Available for clients in France, Canada, and other Francophone countries.

- German: OANDA offers support in German for its clients in Germany, Austria, and Switzerland.

- Italian: Italian-speaking traders can access OANDA’s platform in their native language.

- Portuguese: The platform is available in Portuguese for clients in Brazil and Portugal.

- Chinese: OANDA supports Simplified and Traditional Chinese for its clients in China, Taiwan, and Hong Kong.

- Japanese: Japan is a significant market for OANDA, and the platform is fully available in Japanese.

- Arabic: Traders in the Middle East can access OANDA’s services in Arabic.

By offering support in multiple languages, OANDA ensures that traders from different regions can access its services in a language they are comfortable with, further enhancing the user experience.

Conclusion

OANDA is a versatile and reputable broker with a long history of providing top-tier services to traders around the world. With robust regulatory oversight, top-notch safety measures, and an impressive range of trading platforms, it caters to a wide audience, from beginners to experienced traders. Its regulation under prominent financial authorities and a commitment to transparency add a strong layer of security, making OANDA a reliable choice for trading forex, CFDs, and other assets.

Whether you prefer a simple web platform for manual trading or advanced tools like MT4 and API integration for automated strategies, OANDA delivers an all-around solid trading experience. With no minimum deposit and a wide array of trading instruments, OANDA is a compelling choice for anyone looking to get started or enhance their trading journey.

FAQs

Yes, OANDA is available to traders in the MENA region. The broker provides services in compliance with global financial regulations and ensures its platform is accessible to clients from the Middle East and North Africa.

OANDA is regulated by several leading financial authorities, including the Financial Conduct Authority (FCA) in the UK and other reputable regulators worldwide. While it may not be directly regulated by a specific financial authority in the MENA region, it still adheres to strict international regulatory standards that provide a high level of security for traders in this region.

OANDA offers several account types to meet the needs of traders in the MENA region:

- Standard Account with no minimum deposit.

- Premium Account for high-volume traders with a minimum deposit of $20,000.

- Professional Account for experienced traders who qualify for professional status.

- Demo Account for practice trading without risking real money.

Yes, OANDA offers swap-free Islamic accounts for traders in the MENA region who wish to adhere to Shariah law. This account type does not charge interest (swap fees) on overnight positions, making it suitable for traders seeking halal trading conditions.

Traders in the MENA region can use several payment methods to fund and withdraw from their OANDA trading accounts, including:

- Bank transfers

- Credit and debit cards (Visa, MasterCard)

- Electronic wallets like PayPal and Skrill.

All transactions are secure, and the processing time varies based on the method chosen.

Yes, OANDA provides customer support in Arabic, catering to its clients in the MENA region. The multilingual support ensures that traders can communicate with the broker in their preferred language.

OANDA offers access to multiple trading platforms, including:

- OANDA’s proprietary web and mobile platforms for a seamless trading experience.

- MetaTrader 4 (MT4) for traders who prefer this popular third-party platform. These platforms are available for both desktop and mobile devices, offering flexibility and convenience to traders in the MENA region.