- Founded: 2004

- Headquarters: Poland

- Min deposit: 250 USD

- Max Leverage: 1 : 500

XTB is a renowned forex and CFD broker offering a wide array of trading instruments, making it a popular choice among traders in the MENA region. Known for its user-friendly platform, diverse account types, and comprehensive educational resources, XTB caters to both novice and experienced traders. This review explores XTB’s features, benefits, and potential drawbacks, providing a detailed insight into what makes this broker stand out in the competitive trading landscape.

Company overview

XTB is a globally recognized broker that has been serving traders since its establishment in 2002. With its headquarters in Warsaw, Poland, XTB has expanded its services across numerous countries, including significant operations in the MENA region. The company is known for providing access to a wide range of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies. XTB prides itself on offering a reliable and user-friendly trading experience, which is supported by its robust technological infrastructure and a strong emphasis on customer service.

Regulation and Safety

When it comes to regulation and safety, XTB stands out as a highly regulated broker. It operates under the strict supervision of several top-tier financial authorities. In the MENA region, XTB is regulated by the Dubai Financial Services Authority (DFSA), ensuring that it adheres to the highest standards of financial conduct and transparency. Additionally, XTB is regulated by the Financial Conduct Authority (FCA) in the UK and the Polish Financial Supervision Authority (KNF), among others.

The broker’s regulatory framework ensures that client funds are protected and kept in segregated accounts, separate from the company’s operational funds. This segregation of funds provides an additional layer of security, ensuring that client assets are safe even in the unlikely event of the broker facing financial difficulties. Moreover, XTB offers negative balance protection, which prevents clients from losing more than their initial investment, a critical feature for protecting traders from volatile market swings.

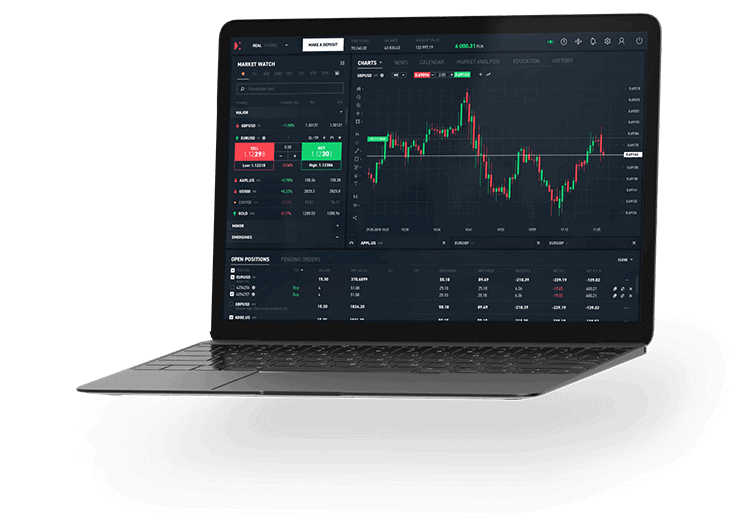

Trading Platforms

XTB offers a selection of trading platforms to cater to the diverse needs of its clients, ranging from beginners to experienced traders. The primary platform provided by XTB is xStation 5, a proprietary platform known for its intuitive design and powerful features. xStation 5 is available on both desktop and mobile devices, allowing traders to manage their accounts and execute trades on the go. The platform offers a range of tools, including advanced charting capabilities, technical analysis indicators, and real-time market news, making it an ideal choice for active traders who require comprehensive market insights.

In addition to xStation 5, XTB also supports the widely popular MetaTrader 4 (MT4) platform. MT4 is renowned for its flexibility and extensive range of tools, including automated trading through Expert Advisors (EAs). This platform is particularly favored by traders who use algorithmic trading strategies or require custom indicators and scripts.

Both platforms offer a demo account option, which is a significant advantage for new traders looking to familiarize themselves with the trading environment before committing real funds. Furthermore, XTB provides educational resources, including webinars, trading guides, and market analysis, to help clients enhance their trading skills and knowledge.

Account Types

XTB offers several account types designed to accommodate traders with varying levels of experience and investment goals. These include:

1. Standard Account

The Standard Account is ideal for retail traders looking for a straightforward and user-friendly experience. It offers access to XTB’s powerful xStation 5 platform, which is equipped with a range of trading tools and features. This account type provides competitive spreads and does not charge commissions on forex trades, making it an attractive option for cost-conscious traders.

2. Pro Account

The Pro Account is tailored for more experienced traders who require tighter spreads and access to higher leverage. This account type features variable spreads that start from as low as 0.1 pips, but a commission is charged on trades. The Pro Account also offers a greater range of advanced tools and features, making it suitable for those who engage in high-frequency trading or use sophisticated trading strategies.

3. Islamic Account

For traders in the MENA region who require Sharia-compliant trading solutions, XTB offers an Islamic Account. This account type operates on a swap-free basis, meaning it does not charge or pay interest on overnight positions. The Islamic Account provides the same access to trading instruments and platforms as the Standard and Pro accounts, ensuring compliance with Islamic financial principles while maintaining a comprehensive trading experience.

4. Demo Account

XTB also offers a Demo Account, which is an excellent tool for both beginners and experienced traders to practice their strategies without risking real money. The Demo Account replicates real market conditions, allowing users to familiarize themselves with the platform and test different trading strategies.

Trading Instruments

XTB boasts an impressive array of trading instruments, making it a versatile broker for traders interested in diverse markets. The broker offers access to over 1,500 financial instruments, including:

1. Forex

XTB provides an extensive selection of currency pairs, covering major, minor, and exotic pairs. This wide range allows traders to engage in currency trading across different global markets, capitalizing on various economic and geopolitical events.

2. Commodities

For those interested in trading commodities, XTB offers contracts for difference (CFDs) on a range of assets, including precious metals like gold and silver, energy products such as oil and natural gas, and agricultural products. This diverse offering enables traders to diversify their portfolios and hedge against market volatility.

3. Indices

XTB provides CFDs on major global indices, including the S&P 500, NASDAQ, FTSE 100, and DAX. Trading indices can be an excellent way for traders to gain exposure to broader market movements rather than individual stocks.

4. Stocks

XTB offers CFD trading on a vast selection of global stocks, allowing traders to speculate on the price movements of individual companies without owning the underlying asset. This includes access to prominent stocks listed on major exchanges such as the NYSE, NASDAQ, and LSE.

5. Cryptocurrencies

In response to the growing popularity of digital currencies, XTB offers CFDs on popular cryptocurrencies like Bitcoin, Ethereum, and Ripple. This allows traders to speculate on the price movements of these digital assets without having to own them directly.

Fees and Spreads

Understanding the fee structure is crucial for traders, as it directly impacts profitability. XTB offers competitive fees and spreads, which vary depending on the account type and instrument traded.

Spreads: For the Standard Account, XTB offers variable spreads starting from 0.35 pips on major forex pairs. The Pro Account provides tighter spreads starting from 0.1 pips, but with an additional commission per lot traded. Spreads on other instruments, such as indices and commodities, are also competitive, making XTB an attractive option for traders seeking cost-efficient trading conditions.

Commissions: XTB does not charge commissions on forex trades for the Standard Account, relying instead on spreads to generate revenue. However, the Pro Account includes a commission fee that varies depending on the instrument. For instance, forex trades may incur a commission of around $3.50 per lot, making it crucial for traders to consider their trading volume and frequency when choosing an account type.

Additional Fees: XTB charges a small inactivity fee for accounts that remain inactive for 12 months. Additionally, there may be fees for deposits and withdrawals, depending on the payment method used. However, these fees are generally reasonable and in line with industry standards.

Pros and Cons

- Competitive Spreads: XTB offers highly competitive spreads, particularly for the Pro Account, where spreads can start as low as 0.1 pips. This is advantageous for traders looking to minimize trading costs.

- No Commission on Standard Account: The Standard Account does not charge commissions on forex trades, making it cost-effective for traders who prioritize fee-free trading.

- Transparent Pricing: XTB provides clear and transparent information regarding its fees and spreads, ensuring traders understand the costs associated with their trades.

- Wide Range of Instruments: XTB offers competitive spreads across various instruments, including forex, indices, commodities, and cryptocurrencies, catering to diverse trading strategies.

- Commission on Pro Account: While the Pro Account offers tighter spreads, it comes with a commission per lot traded, which can add up for high-frequency traders.

- Inactivity Fee: XTB charges an inactivity fee if an account remains inactive for 12 months, which can be a drawback for occasional traders or those who take breaks from trading.

- Fees for Certain Payment Methods: Some deposit and withdrawal methods may incur fees, which could affect traders’ overall costs, especially if they frequently move funds in and out of their trading accounts.

- Variable Spreads: As spreads are variable, they can widen during periods of high market volatility, potentially increasing trading costs unexpectedly.

Leverage Options

XTB provides competitive leverage options, making it suitable for various types of traders, from beginners to more experienced investors. The broker offers leverage up to 1:500 for professional clients, while retail clients can access leverage up to 1:30. This range allows traders to amplify their positions, enhancing potential returns. However, it’s crucial to remember that higher leverage increases both potential profits and losses, necessitating careful risk management.

For retail clients, the leverage is capped due to regulatory requirements, which is a standard practice in the industry to protect less experienced traders from significant losses. This setup ensures that even those new to trading can participate without taking on excessive risk.

Customer Support

XTB is renowned for its robust customer support, offering 24/5 assistance through multiple channels. Traders can reach out via live chat, email, or phone, with support available in multiple languages. The broker’s customer service team is knowledgeable and responsive, addressing queries efficiently.

One notable feature of XTB’s support system is its educational resources, which are comprehensive and cover a wide range of topics. These resources are invaluable for both novice and experienced traders, offering insights into trading strategies, market analysis, and platform tutorials. The broker’s dedication to customer education demonstrates its commitment to helping clients succeed in the markets.

Payment Methods

XTB offers a wide range of payment methods, accommodating the diverse needs of its international clientele. Clients can fund their accounts through bank transfers, credit/debit cards, and popular e-wallets such as PayPal and Skrill. This variety ensures that traders can choose the most convenient and cost-effective method based on their location and personal preferences. The broker’s policy of not charging deposit fees is particularly advantageous, allowing traders to manage their capital more efficiently without incurring additional costs.

Withdrawal processes are generally straightforward, with minimal fees involved. However, the time it takes to process withdrawals can vary depending on the method chosen. For instance, e-wallet transactions are typically processed quickly, often within a few hours, providing traders with rapid access to their funds. In contrast, bank transfers might take several business days. The flexibility and efficiency of XTB’s payment system enhance the overall trading experience, ensuring that clients can focus on trading rather than worrying about financial logistics.

Supported Languages

As a global broker, XTB offers support in over 20 languages, making it accessible to a broad spectrum of traders worldwide. This extensive language support is particularly valuable in the MENA region, where linguistic diversity is significant. The platform and customer service are available in major languages such as Arabic, English, French, Spanish, and Turkish, among others. This ensures that traders can navigate the platform and access assistance in their native language, reducing misunderstandings and enhancing user experience.

The availability of educational materials in multiple languages further solidifies XTB’s commitment to inclusivity and accessibility. By providing comprehensive resources in various languages, XTB enables a wider audience to benefit from its educational content, helping traders improve their knowledge and skills regardless of their linguistic background. This inclusive approach not only enhances customer satisfaction but also fosters a more diverse and global trading community.

Conclusion

XTB is a robust option for traders in the MENA region, offering a blend of competitive trading conditions, comprehensive educational resources, and strong regulatory oversight. While the broker does charge fees under specific conditions, its transparent pricing and extensive support make it a reliable choice for both beginners and experienced traders. With its commitment to providing a secure and user-friendly trading environment, XTB stands out as a trusted partner in the financial markets.

FAQs

XTB is a global brokerage firm offering a wide range of trading instruments, including forex, indices, commodities, cryptocurrencies, and more. It is known for its advanced trading platforms, competitive spreads, and robust educational resources. XTB caters to both retail and professional clients, providing services that adhere to international regulatory standards.

XTB offers leverage up to 1:500 for professional clients, while retail clients can access leverage up to 1:30. The specific leverage available depends on the asset being traded and the client’s classification (retail or professional). Leverage is a double-edged sword, potentially increasing both profits and losses, so it should be used cautiously.

XTB offers two main trading platforms: xStation 5 and MetaTrader 4 (MT4). xStation 5 is XTB’s proprietary platform, known for its user-friendly interface and advanced trading tools. MT4 is a popular platform among forex traders, offering robust charting tools and automated trading capabilities.

XTB supports a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets such as PayPal and Skrill. The broker does not charge deposit fees, and withdrawal fees are generally minimal, although they can vary depending on the method and region.

XTB offers its services in over 20 languages, including Arabic, English, French, Spanish, and Turkish. This extensive language support ensures that clients from different regions can access the platform and customer service in their preferred language.

Yes, XTB offers a free demo account, which allows users to practice trading without risking real money. The demo account is an excellent way for new traders to familiarize themselves with the platform and test their strategies in a risk-free environment.

XTB provides 24/5 customer support through various channels, including live chat, phone, and email. The support team is multilingual and capable of assisting with a wide range of queries, from technical issues to trading-related questions.