- Founded: 2005

- Headquarters: USA

- Min deposit: 50 USD

- Max Leverage: 1 : 500

MultiBank Group, established in 2005, has grown to become one of the leading online financial derivatives providers globally, including in the MENA region. With a presence in over 90 countries and a clientele exceeding 320,000, MultiBank Group offers an array of trading instruments and platforms designed to cater to both novice and experienced traders. This review will delve into the various aspects of MultiBank Group’s offerings, from their trading platforms and account types to customer support and regulatory compliance, providing you with a comprehensive analysis to determine if this broker aligns with your trading needs.

Regulation and Safety

When it comes to online trading, regulation and safety are paramount. MultiBank Group excels in this area, being one of the most heavily regulated brokers globally. The broker is regulated by several top-tier financial authorities, including:

- ASIC (Australian Securities and Investments Commission)

- FCA (Financial Conduct Authority)

- BaFin (Federal Financial Supervisory Authority)

- DFSA (Dubai Financial Services Authority)

These regulatory bodies are known for their stringent requirements and high standards, ensuring that MultiBank Group adheres to the best practices in financial services. For traders in the MENA region, the DFSA regulation is particularly reassuring, providing a local regulatory framework that ensures transparency and security.

MultiBank Group also employs robust safety measures to protect its clients’ funds. Client funds are held in segregated accounts, meaning they are kept separate from the company’s operating funds. This segregation ensures that, in the unlikely event of the broker’s insolvency, client funds remain protected. Furthermore, MultiBank Group offers negative balance protection, which ensures that clients cannot lose more than their initial investment, adding an extra layer of security.

Trading Platforms

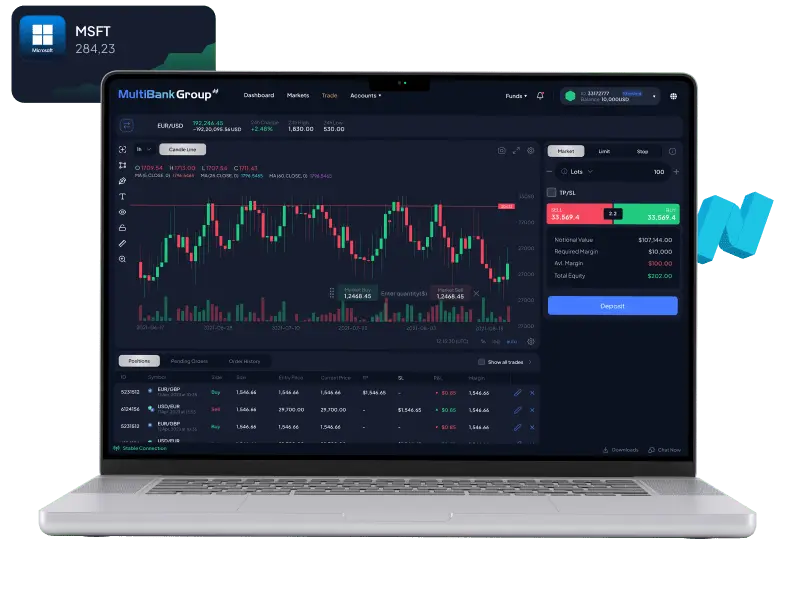

MultiBank Group offers a variety of trading platforms designed to cater to the needs of different types of traders, from beginners to advanced professionals. The primary platforms offered by MultiBank Group are MetaTrader 4 (MT4), MetaTrader 5 (MT5), and MultiBank’s proprietary platform, Maximus.

MetaTrader 4 (MT4)

MT4 is a highly popular trading platform known for its user-friendly interface, comprehensive charting tools, and automated trading capabilities through Expert Advisors (EAs). Traders can access a wide range of indicators and analytical tools to help make informed trading decisions. MT4 is available on desktop, web, and mobile devices, ensuring traders can access the markets from anywhere.

MetaTrader 5 (MT5)

MT5 builds on the success of MT4, offering additional features and enhanced performance. It includes more timeframes, advanced charting tools, and an economic calendar. MT5 also supports more types of orders and execution modes, making it suitable for professional traders who require advanced functionality.

Maximus

Maximus is MultiBank Group’s proprietary trading platform, designed to offer a seamless trading experience with advanced features. It provides access to a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. Maximus is equipped with powerful trading tools, comprehensive market analysis, and an intuitive interface, making it suitable for traders of all levels.

In addition to these platforms, MultiBank Group offers its clients access to a range of educational resources, including webinars, tutorials, and market analysis, helping traders to enhance their skills and knowledge.

Account Types

MultiBank Group provides a variety of account types to suit different trading styles and experience levels. Each account type offers unique features and benefits, ensuring that traders can find an account that meets their specific needs.

Standard Account

The Standard Account is ideal for beginner traders who are just starting out in the markets. It requires a minimum deposit of $50 and offers competitive spreads starting from 1.5 pips. Traders can access a wide range of trading instruments and leverage of up to 1:500. The Standard Account provides access to all trading platforms offered by MultiBank Group.

Pro Account

The Pro Account is designed for more experienced traders who require tighter spreads and enhanced trading conditions. With a minimum deposit of $1,000, the Pro Account offers spreads starting from 0.8 pips and leverage of up to 1:500. This account type also provides access to a dedicated account manager, ensuring that traders receive personalized support and assistance.

ECN Account

The ECN Account is suitable for professional traders who demand the best trading conditions. This account type requires a minimum deposit of $5,000 and offers raw spreads starting from 0.0 pips. The ECN Account provides direct market access (DMA), ensuring that traders receive the best possible prices and execution speeds. Leverage is available up to 1:500, and traders benefit from lower commissions and deeper liquidity.

Islamic Account

For traders in the MENA region who adhere to Islamic principles, MultiBank Group offers an Islamic Account. This account type is fully compliant with Sharia law, ensuring that no interest is charged or earned on overnight positions. The Islamic Account is available with the same features and benefits as the Standard, Pro, and ECN accounts, providing flexibility and choice for Muslim traders.

Trading Instruments

MultiBank Group offers an extensive range of trading instruments, catering to a wide array of traders’ preferences and strategies. Their offerings include:

Forex Trading: MultiBank Group provides access to over 55 currency pairs, covering major, minor, and exotic pairs. This wide selection allows traders to diversify their portfolios and capitalize on various market conditions.

Metals: Traders can invest in precious metals like gold and silver. These commodities are popular among traders looking to hedge against inflation or geopolitical uncertainties.

Indices: The broker offers a variety of global indices, including major ones like the S&P 500, NASDAQ, FTSE 100, and more. Trading indices can be an excellent way to gain exposure to entire market segments without having to pick individual stocks.

Commodities: Beyond precious metals, MultiBank Group also provides trading in commodities such as oil, gas, and agricultural products. These instruments are crucial for traders looking to diversify into physical goods markets.

Shares: Traders can access a broad selection of shares from major global markets, including the US, UK, Europe, and Asia. This feature is particularly beneficial for those interested in equity trading without directly buying stocks.

Cryptocurrencies: Recognizing the growing interest in digital assets, MultiBank Group offers trading in popular cryptocurrencies like Bitcoin, Ethereum, and Ripple. This inclusion enables traders to tap into the volatile yet potentially lucrative crypto market.

The variety of trading instruments available at MultiBank Group ensures that traders can find opportunities across different asset classes and market conditions, making it a versatile choice for both beginners and experienced traders.

Fees and Spreads

When it comes to fees and spreads, MultiBank Group is known for its competitive pricing structure, though specifics can vary based on the type of account and trading volume.

Spreads: MultiBank Group offers tight spreads, starting from 0.0 pips for some of their account types. The tightness of spreads can significantly impact a trader’s profitability, especially for those engaging in high-frequency trading. It’s worth noting that spreads may widen during periods of high market volatility.

Commission Fees: For certain account types, particularly those with lower spreads, MultiBank Group charges a commission per trade. The commission rates are generally competitive, but it’s essential for traders to understand how these fees might affect their overall trading costs.

Swap Fees: Like most brokers, MultiBank Group charges swap fees for holding positions overnight. These fees can vary depending on the trading instrument and market conditions. It’s advisable for traders to check the swap rates for their specific trades to avoid unexpected costs.

Inactivity Fees: MultiBank Group charges an inactivity fee if an account is dormant for a certain period. Traders should be aware of this to avoid unnecessary charges.

Overall, MultiBank Group’s fee structure is designed to be transparent and competitive. However, traders should carefully review the specific costs associated with their account type and trading strategy to ensure they are getting the best deal.

Pros and Cons

Competitive Spreads: MultiBank Group offers tight spreads starting from 0.0 pips for certain account types, which can enhance profitability for traders, especially those engaging in high-frequency trading.

Transparent Fee Structure: The broker provides clear information about their fees, helping traders understand the costs associated with their trading activities upfront.

Commission-Based Accounts: For accounts with lower spreads, the commission fees are generally competitive, making them suitable for traders who prefer tighter spreads even if they incur a per-trade fee.

Variety of Account Types: MultiBank Group offers multiple account types with varying fee structures, allowing traders to choose an account that best suits their trading volume and strategy.

No Deposit or Withdrawal Fees: The broker typically does not charge fees for deposits or withdrawals, which is a significant advantage for traders who frequently move their funds.

Swap Fees: Overnight swap fees can add up, particularly for traders who hold positions for extended periods. It’s essential for traders to factor these costs into their overall strategy.

Inactivity Fees: MultiBank Group charges an inactivity fee if an account remains dormant for a specified period. Traders need to stay active or be aware of these charges to avoid unnecessary costs.

Variable Spreads: During periods of high market volatility, spreads can widen significantly, potentially increasing trading costs unexpectedly.

Commission Fees on Some Accounts: While commission-based accounts offer lower spreads, the per-trade commission might not be suitable for all traders, particularly those with lower trading volumes.

Complex Fee Structure: The variety of fees and charges associated with different account types and trading instruments can be complex, requiring traders to thoroughly review and understand the costs involved.

Leverage Options

Leverage is a significant feature in trading, allowing traders to control large positions with a relatively small amount of capital. MultiBank Group offers various leverage options, which can be tailored to suit different trading styles and risk tolerances.

Forex Leverage: For forex trading, MultiBank Group offers leverage up to 1:500. This high leverage can amplify profits but also increases the potential for substantial losses. Therefore, it’s crucial for traders to use leverage responsibly and have a robust risk management strategy in place.

Metals and Commodities Leverage: Leverage for trading metals and commodities is typically lower than for forex, reflecting the higher volatility of these markets. MultiBank Group offers leverage up to 1:200 for these instruments.

Indices Leverage: The leverage for trading indices at MultiBank Group can go up to 1:200, allowing traders to take advantage of market movements across major global indices.

Shares Leverage: Trading shares with MultiBank Group comes with leverage up to 1:20. This relatively lower leverage is due to the individual nature of stocks, which can be more unpredictable compared to currency pairs or indices.

Cryptocurrencies Leverage: Given the volatile nature of cryptocurrencies, leverage for these instruments is typically lower, with MultiBank Group offering up to 1:10. This conservative leverage approach helps mitigate the risks associated with the highly fluctuating crypto market.

Customer Support

MultiBank Group prides itself on providing robust customer support to its clients, ensuring that traders have the necessary assistance whenever required. The broker offers 24/7 customer support through multiple channels, including live chat, email, and telephone. This round-the-clock service is particularly beneficial for traders who operate in different time zones and need timely assistance.

The live chat feature is available directly on the MultiBank Group website, providing instant support for any trading-related queries. This is often the fastest way to get help, with response times typically under a minute. The representatives are knowledgeable and courteous, aiming to resolve issues promptly and efficiently.

For those who prefer more traditional methods of communication, MultiBank Group offers email support. Customers can expect a response within 24 hours, although during peak times, it might take slightly longer. The email support team is well-versed in handling a variety of issues, from technical problems to account-related queries.

Telephone support is another strong point for MultiBank Group. They provide dedicated phone lines for different regions, ensuring that clients can get localized support. This is particularly useful for complex issues that may require a more detailed discussion. The phone support staff are professional and have a deep understanding of the broker’s services and trading platform.

Additionally, MultiBank Group has an extensive FAQ section on their website. This resource covers a wide range of topics, including account setup, trading platforms, and financial instruments, providing quick answers to common questions. Overall, MultiBank Group’s customer support is comprehensive and well-structured, catering to the diverse needs of its global clientele.

Payment Methods

When it comes to funding your trading account, MultiBank Group offers a variety of payment methods to ensure convenience and flexibility. These methods include bank transfers, credit/debit cards, and several e-wallet options, catering to a wide range of preferences.

Bank Transfers are one of the most secure ways to fund your account, although they may take a few days to process. MultiBank Group supports transfers from a variety of banks globally, making it a versatile option for many traders. There are no fees charged by MultiBank Group for bank transfers, although your bank might levy some charges.

Credit and Debit Cards are also accepted, including major providers like Visa and MasterCard. This method is popular due to its speed, as funds are typically available in your trading account almost instantly. There are no deposit fees, but it is essential to check with your card provider for any associated costs.

E-wallets are increasingly popular among traders for their convenience and speed. MultiBank Group supports several e-wallet options, including Neteller, Skrill, and PayPal. E-wallet transactions are processed quickly, usually within a few hours, allowing traders to start trading without delay. These methods often have lower fees compared to traditional banking options, making them an attractive choice for many.

In terms of withdrawals, MultiBank Group aims to process requests within 24 hours, although the actual time for the funds to reach your account may vary depending on the method used. Withdrawal fees are generally low, but it’s advisable to check the specific terms for each method.

The broker’s flexible and diverse payment methods make it easy for traders from different regions to deposit and withdraw funds with minimal hassle. This flexibility is crucial for maintaining liquidity and ensuring that traders can access their funds when needed.

Supported Languages

As a global broker, MultiBank Group understands the importance of catering to a diverse client base by offering support in multiple languages. This approach not only enhances user experience but also ensures that traders from various regions can access information and support in their native language.

MultiBank Group’s website is available in several languages, including but not limited to English, Arabic, Spanish, Chinese, and German. This multilingual support extends to their trading platforms and customer service, ensuring that traders can operate comfortably in their preferred language.

For traders in the MENA region, Arabic support is particularly noteworthy. The website, trading platforms, and customer support are all accessible in Arabic, ensuring that clients can navigate the services and seek assistance without any language barriers. This is a significant advantage for Arabic-speaking traders who might find it challenging to trade with brokers that only offer support in English.

The availability of multiple languages reflects MultiBank Group’s commitment to inclusivity and customer satisfaction. It allows traders from different parts of the world to engage with the broker’s services seamlessly, enhancing their overall trading experience.

Conclusion

MultiBank Group stands out as a robust and reliable broker, especially for traders in the MENA region. Its comprehensive range of platforms, strong regulatory oversight, competitive trading conditions, and excellent customer support make it a strong contender in the market. While there are some minor drawbacks, such as inactivity and withdrawal fees, the overall offering is impressive. Whether you are a novice trader or a seasoned professional, MultiBank Group provides the tools and support needed to navigate the financial markets effectively.

If you are looking for a broker that combines reliability, flexibility, and competitive trading conditions, MultiBank Group is certainly worth considering for your trading needs.

FAQs

MultiBank Group is a global financial services provider established in 2005. It offers a wide range of trading services, including forex, commodities, indices, and cryptocurrencies. The company is known for its robust trading platforms, competitive spreads, and extensive regulatory oversight.

Yes, MultiBank Group is highly regulated. It operates under multiple licenses from renowned regulatory authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Market Authority (FMA) in Austria, and the Hong Kong Securities and Futures Commission (SFC). This ensures a high level of security and transparency for clients.

MultiBank Group offers several advanced trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and MultiBank’s proprietary platform, Maximus. These platforms are available for desktop, web, and mobile devices, providing flexibility and convenience for traders.

MultiBank Group offers various account types to suit different trading needs, including the Standard, Pro, and ECN accounts. Each account type has its own set of features and benefits, such as different spreads, leverage options, and minimum deposit requirements.

The minimum deposit requirement varies depending on the account type. For the Standard account, the minimum deposit is typically $50. The Pro and ECN accounts may require higher minimum deposits, reflecting their advanced features and lower spreads.

MultiBank Group supports a variety of payment methods for deposits, including bank transfers, credit/debit cards, and e-wallets such as Neteller, Skrill, and PayPal. Deposits are generally processed quickly, allowing you to start trading without delay.

Withdrawal requests are typically processed within 24 hours. However, the actual time for funds to reach your account may vary depending on the withdrawal method used. Bank transfers might take a few days, while e-wallet withdrawals are usually faster.