- Founded: 2014

- Headquarters: Seychelles

- Min deposit: 100 USD

- Max Leverage: 1 : 1000

Tickmill is a globally recognized broker, offering a wide range of trading instruments and platforms tailored for both novice and experienced traders. In this review, we will delve into the various aspects of Tickmill’s services, focusing on its offerings in the MENA region. From account types and fees to trading platforms and customer support, we provide an in-depth analysis to help you decide if Tickmill is the right broker for your trading needs.

Company Overview

Founded in 2014, Tickmill has rapidly grown into a reputable broker with a strong presence in the MENA region. The broker is regulated by several top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). This multi-regulatory oversight ensures a high level of security and transparency for clients.

Regulation and Safety

One of the most critical aspects of choosing a broker is ensuring they operate under stringent regulatory oversight. Tickmill excels in this area, being regulated by several top-tier financial authorities. The broker is authorized and regulated by the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). This multi-jurisdictional regulation ensures that Tickmill adheres to high standards of financial integrity and transparency.

Client Fund Security

Tickmill takes the safety of client funds seriously. The broker employs segregated accounts, which means that client funds are kept separate from the company’s operating funds. This segregation minimizes the risk of clients’ money being used for any purpose other than trading. Additionally, Tickmill is a member of the Financial Services Compensation Scheme (FSCS) in the UK, providing an extra layer of protection for clients up to £85,000.

Data Protection and Cybersecurity

In an era where cybersecurity threats are rampant, Tickmill prioritizes the protection of client data. The broker employs advanced encryption technologies and stringent data protection protocols to ensure that personal and financial information remains secure. Regular audits and security assessments further bolster Tickmill’s commitment to safeguarding its clients’ interests.

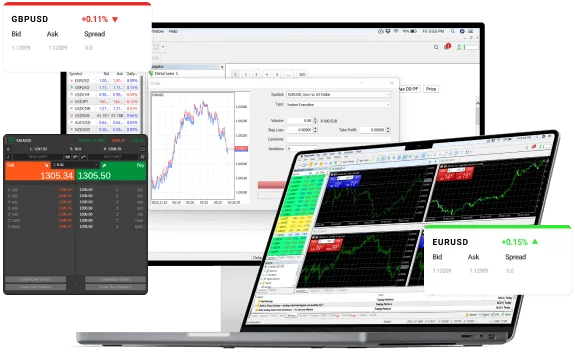

Trading Platforms

Tickmill offers a range of trading platforms to cater to different trading styles and preferences. The primary platform provided is MetaTrader 4 (MT4), renowned for its user-friendly interface, advanced charting tools, and extensive range of technical indicators.

MetaTrader 4 (MT4)

MT4 is a staple in the trading community, and Tickmill’s integration of this platform ensures a seamless trading experience. The platform is available on desktop, web, and mobile devices, allowing traders to access their accounts and trade on the go. MT4’s features include:

- Advanced Charting: With multiple chart types, timeframes, and analytical tools, MT4 provides a comprehensive suite for technical analysis.

- Expert Advisors (EAs): Automated trading is made easy with EAs, enabling traders to execute trades based on pre-set criteria.

- Custom Indicators: Traders can create and use custom indicators to enhance their trading strategies.

WebTrader

For traders who prefer not to download software, Tickmill offers WebTrader, a browser-based platform that retains much of MT4’s functionality. WebTrader is accessible from any internet-enabled device and provides real-time market data, advanced charting tools, and seamless execution.

Mobile Trading

Tickmill’s mobile trading platforms ensure that traders can manage their accounts and trade from anywhere. Available for both iOS and Android, the mobile apps offer a user-friendly interface, real-time quotes, and full account management features.

Account Types

Tickmill understands that traders have varying needs and preferences, which is why they offer multiple account types to cater to different trading styles.

Classic Account

The Classic Account is ideal for new traders or those who prefer a simple, straightforward trading experience. This account type features:

- No Commissions: Trades are commission-free, with costs incorporated into the spread.

- Competitive Spreads: Spreads start from as low as 1.6 pips.

- Minimum Deposit: The minimum deposit is $100, making it accessible for beginners.

Pro Account

Designed for more experienced traders, the Pro Account offers tighter spreads and lower trading costs. Features include:

- Low Commissions: A competitive commission structure of $2 per side per lot.

- Tight Spreads: Spreads starting from 0.0 pips.

- Minimum Deposit: A minimum deposit of $100.

VIP Account

The VIP Account is tailored for high-volume traders who require the best trading conditions. This account offers:

- Ultra-Low Commissions: Commissions as low as $1 per side per lot.

- Tightest Spreads: Spreads starting from 0.0 pips.

- Dedicated Support: Access to a dedicated account manager.

- Minimum Deposit: A higher minimum deposit requirement of $50,000.

Islamic Account

For traders in the MENA region who require Sharia-compliant trading, Tickmill offers an Islamic Account. This account type features:

- No Swap Charges: Interest-free trading conditions.

- Same Features: The same trading conditions as the Classic and Pro accounts, with no overnight interest charges.

Trading Instruments

Tickmill offers an extensive selection of trading instruments, catering to diverse trading preferences and strategies. Clients can trade in the following categories:

Forex: With over 60 currency pairs, Tickmill provides access to major, minor, and exotic pairs. This variety allows traders to take advantage of global currency market movements.

Commodities: Investors can trade popular commodities like gold, silver, crude oil, and natural gas. These instruments are favored for their liquidity and potential as hedges against market volatility.

Indices: Tickmill offers CFDs on major global indices, including the S&P 500, NASDAQ, FTSE 100, DAX 30, and more. Trading indices allows investors to speculate on the performance of entire markets rather than individual stocks.

Stocks: Through CFDs, traders can speculate on the price movements of shares from major companies worldwide. This is an excellent option for those interested in equity markets without owning the underlying assets.

Bonds: Tickmill also provides access to bond trading, including German Bunds and UK Gilts. Bonds can be a stable addition to a diversified trading portfolio.

Cryptocurrencies: For those looking to enter the digital currency market, Tickmill offers CFDs on popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

The wide range of instruments ensures that traders of all types can find suitable opportunities, whether they prefer forex, commodities, indices, stocks, bonds, or cryptocurrencies.

Fees and Spreads

Tickmill is known for its competitive fee structure, which is particularly appealing to cost-conscious traders. Here’s a detailed look at their fees and spreads:

Spreads: Tickmill offers some of the lowest spreads in the industry. For major currency pairs, spreads can start as low as 0.0 pips on the Pro and VIP accounts. This low-cost trading environment is ideal for high-frequency traders and scalpers who benefit from minimal trading costs.

Commissions: While the Classic account is commission-free, the Pro and VIP accounts incur commissions. The Pro account charges $2 per side per 100,000 traded, making it $4 round trip. The VIP account, tailored for high-volume traders, offers even lower commissions at $1 per side per 100,000 traded.

Swap Rates: Tickmill applies swap rates on positions held overnight. These rates vary depending on the instrument and market conditions. Traders can view the swap rates directly on the trading platform.

Inactivity Fee: Unlike many brokers, Tickmill does not charge an inactivity fee. This policy is beneficial for traders who may take breaks between trading sessions.

Overall, Tickmill’s fee structure is highly competitive, particularly in the Pro and VIP account types, making it an attractive option for active traders who seek to minimize costs.

Pros and Cons

- Low Spreads: Tickmill offers some of the lowest spreads in the industry, especially on major currency pairs, starting from 0.0 pips on the Pro and VIP accounts. This is particularly advantageous for high-frequency traders and scalpers who seek to minimize trading costs.

- Competitive Commissions: The Pro and VIP accounts have very competitive commission rates. The Pro account charges $2 per side per 100,000 traded, while the VIP account charges only $1 per side, making it ideal for high-volume traders.

- No Inactivity Fees: Unlike many brokers, Tickmill does not charge inactivity fees, which is beneficial for traders who do not trade frequently or take breaks between trading sessions.

- Transparency: Tickmill maintains a transparent fee structure, allowing traders to clearly understand the costs associated with their trades.

- Commission Charges on Pro and VIP Accounts: While the Classic account is commission-free, traders using the Pro and VIP accounts will incur commission fees. This might not be ideal for traders who prefer a purely spread-based cost structure.

- Swap Rates: Tickmill applies swap rates on positions held overnight. While this is standard practice, it can add to the cost of trading, especially for those who hold positions for extended periods.

- Variable Spreads: Although Tickmill offers low spreads, they are variable, meaning they can widen during periods of high market volatility. This could increase trading costs unpredictably during such times.

- Account Type Dependency: The benefits of low spreads and competitive commissions are tied to the type of account held. Traders with smaller accounts who use the Classic account may not benefit from the lower spreads and might prefer the Pro or VIP accounts for better rates, but these require higher deposits or trading volumes.

Leverage Options

Leverage is a significant aspect of trading, allowing traders to control larger positions with a relatively small amount of capital. Tickmill offers flexible leverage options, accommodating both conservative and aggressive trading styles.

Forex Leverage: For forex trading, leverage is available up to 1:500. This high leverage can significantly amplify both profits and losses, so it is essential for traders to use it judiciously and have a solid risk management strategy in place.

Commodity Leverage: Leverage for commodities varies depending on the specific asset. For example, gold can be traded with leverage up to 1:500, while other commodities like oil may have lower leverage limits.

Indices and Bonds: Leverage on indices and bonds typically ranges up to 1:100. This level of leverage is sufficient to enhance trading potential while keeping risks more manageable compared to forex trading.

Cryptocurrency Leverage: Tickmill offers leverage up to 1:20 on cryptocurrency CFDs. Given the volatile nature of cryptocurrencies, this leverage level strikes a balance between enabling traders to capitalize on market movements and managing risk exposure.

Tickmill’s leverage offerings are designed to cater to a broad spectrum of traders, from those who prefer lower-risk strategies to those who thrive on higher risk and potential reward scenarios.

Customer Support

Customer support is a vital aspect of any brokerage service, and Tickmill excels in this area. They offer multiple channels for customer assistance, ensuring traders can get help whenever they need it. Here’s a closer look at the support structure:

Availability and Responsiveness:

Tickmill provides 24/5 customer support, aligning with the global trading week. This ensures that traders can reach out for assistance during most trading hours. The support team is known for its prompt response, often resolving issues quickly and efficiently.

Support Channels:

- Live Chat: The live chat feature on Tickmill’s website is particularly commendable. It connects traders with support agents in real-time, providing immediate assistance for urgent queries.

- Email Support: For more detailed inquiries, traders can email the support team. Tickmill typically responds within 24 hours, offering comprehensive solutions.

- Telephone Support: Direct phone support is available for traders who prefer a more personal touch. This service is praised for its clarity and helpfulness, making it easy to resolve complex issues.

Quality of Support:

Tickmill’s support staff are well-trained and knowledgeable, capable of assisting with a wide range of issues from technical problems to account inquiries. The professionalism and expertise of the support team contribute to a positive trading experience.

Payment Methods

Tickmill offers a variety of payment methods, catering to the diverse needs of traders in the MENA region. This flexibility ensures that depositing and withdrawing funds is both convenient and secure.

Deposit Methods:

Bank Transfers: Traditional bank transfers are supported, allowing direct transactions from local banks. This method, while secure, can take several days to process.

Credit/Debit Cards: Tickmill accepts major credit and debit cards, including Visa and MasterCard. Transactions are processed quickly, usually within a few hours.

E-Wallets: Popular e-wallets such as Skrill and Neteller are also supported. These methods offer fast and convenient transactions, often processed within minutes.

Local Payment Methods: For added convenience, Tickmill supports local payment methods specific to the MENA region, ensuring that traders can fund their accounts with ease.

Withdrawal Methods:

Withdrawal options mirror the deposit methods, ensuring consistency and ease of use. The processing times for withdrawals are generally fast, with e-wallets and card withdrawals typically completed within 24 hours, while bank transfers may take a few days.

Fees and Charges:

Tickmill is transparent about its fees, with most deposit and withdrawal methods being free of charge. However, it’s important for traders to check if their payment provider imposes any fees on transactions, as these are outside Tickmill’s control.

Supported Languages

Catering to a global clientele, Tickmill supports a variety of languages, enhancing accessibility and user experience for traders from different regions.

Primary Languages:

English: As the primary language for international business, English is fully supported across all Tickmill’s platforms and services.

Arabic: Recognizing the importance of the MENA region, Tickmill provides comprehensive support in Arabic, ensuring that Arabic-speaking traders can navigate the platform and access support without language barriers.

Additional Languages:

Besides English and Arabic, Tickmill supports several other languages including but not limited to:

- Spanish

- German

- French

- Chinese

This multilingual support underscores Tickmill’s commitment to serving a diverse global client base.

Language-Specific Resources:

Tickmill goes beyond basic language support by offering educational materials, webinars, and customer support in multiple languages. This ensures that traders can access valuable resources and assistance in their native language, enhancing their overall trading experience.

Conclusion

Tickmill stands out as a reliable and competitive broker in the MENA region. Its multi-regulatory oversight, coupled with low fees, diverse trading instruments, and robust customer support, make it an attractive choice for traders of all levels. Whether you are a novice trader looking to get started or an experienced trader seeking advanced trading conditions, Tickmill offers the tools and resources to help you succeed in the financial markets.

By focusing on both the technical and psychological aspects of trading, Tickmill ensures that its clients are well-equipped to navigate the complexities of the financial markets. With its commitment to transparency, education, and customer satisfaction, Tickmill has earned its reputation as a top broker in the MENA region.

FAQs

Tickmill is a global brokerage firm that provides trading services in forex, commodities, and indices. Known for its competitive trading conditions, Tickmill offers a variety of account types and trading platforms to cater to both novice and experienced traders.

Yes, Tickmill is regulated by several reputable financial authorities including:

- The Financial Conduct Authority (FCA) in the UK.

- The Cyprus Securities and Exchange Commission (CySEC).

- The Financial Sector Conduct Authority (FSCA) in South Africa.

- The Seychelles Financial Services Authority (FSA).

Tickmill provides access to the following trading platforms:

- MetaTrader 4 (MT4): A popular and user-friendly platform known for its robust charting tools and automated trading capabilities.

- MetaTrader 5 (MT5): An upgraded version of MT4, offering additional features such as more timeframes and advanced charting tools.

Tickmill provides various educational resources to help traders improve their skills:

- Webinars: Regular online seminars covering different trading topics.

- Ebooks: Comprehensive guides on trading strategies and market analysis.

- Videos: Educational videos explaining various aspects of trading.

- Blog: Articles on market updates and trading tips.

Yes, Tickmill offers demo accounts which are a great way for new traders to practice trading in a risk-free environment. The demo accounts provide access to real market conditions without using real money.

Yes, Tickmill is suitable for beginners. The broker offers a Classic account with user-friendly features, educational resources to enhance trading knowledge, and a demo account for practice.

Tickmill occasionally offers bonuses and promotions. It is recommended to check their website or contact their customer support for the latest offers.